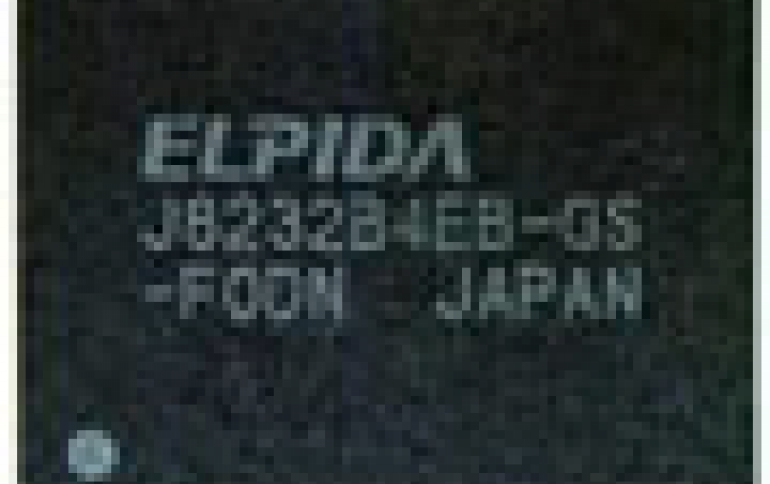

Bankruptcy-Bound Elpida Dethrones Micron from Third Rank in DRAM Market

In an ironic development, bankrupt Elpida Memory in the first quarter managed to outperform the overall DRAM industry and its close competitors, allowing it to rise one position to take the third rank among global suppliers.

According to an IHS iSupply research, the company that Elpida displaced from the third rank was Micron Technology, the supplier most likely to acquire Elpida.

Japan?s Elpida stepped into third place by grabbing 12.6 percent market share on the strength of a nearly 1 percent increase in revenue compared to the fourth quarter of 2011, according to an IHS iSuppli DRAM Market Brief report. While this growth may seem marginal, Elpida outperformed the overall DRAM market, which in the third quarter posted sales of $6.2 billion, down 4.4 percent from $6.5 billion in the fourth quarter of 2011, as shown in the table below. Elpida also surpassed its closest competitor, U.S.-based Micron, whose sales declined by 3 percent during the same period, causing it to fall one position to fourth place.

"Elpida?s displacement of Micron for the No. 3 spot is paradoxical, especially as Micron on May 7 won the right to bid exclusively to buy the Japanese company, after Hynix Semiconductor Inc. and Toshiba Corp. dropped out of the bidding race," said Mike Howard, senior principal analyst for DRAM & memory research at IHS. "Because it would derive the most benefit and has the requisite cash to make a deal, Micron was the most logical choice to purchase Elpida, which filed for bankruptcy in February after incurring more than $5 billion in debt and running up a string of quarterly losses."

Micron now must negotiate with Elpida on a number of sensitive issues, including retiring or restructuring the Japanese maker's massive liabilities. Micron must also figure out what to do with Elpida's huge facility in Hiroshima, Japan, especially as the strength of the yen renders manufacturing there uncompetitive.

For Micron, which only in the third quarter last year had captured third place after 20 consecutive quarters in the No. 4 spot, the unhappy return to familiar territory was the result of a 16 percent decline in average selling prices. The drop neutralized the 15 percent gain in the first quarter that the company achieved with its shipments, causing sales for the only U.S.-based DRAM maker to retreat to $759 million, equivalent to 12.2 percent share of the market.

Samsung Electronics and Hynix Semiconductor Inc. remained the Top 2 DRAM manufacturers in the first quarter.

Samsung saw its share diminish slightly to 40.8 percent on sales of $2.5 billion, down sequentially from 43.2 percent. Despite the slippage, Samsung has controlled more than 40 percent of the DRAM market for the last four quarters. The electronics giant is believed to be biding its time to ramp up shipment growth until the end of the year, when DRAM prices are anticipated to be higher.

Meanwhile, runner-up Hynix continued to see its market share climb during the first quarter, reaching its highest level ever at 24.2 percent on sales of $1.5 billion.

Rounding out the Top 5 was Nanya Technology Corp. of Taiwan, which increased its wafer output back to typical levels after throttling production at the end of last year. Nanya increased revenue by an industry-leading 24.2 percent in the first quarter, allowing it to capture 4.5 percent of the DRAM market.

Japan?s Elpida stepped into third place by grabbing 12.6 percent market share on the strength of a nearly 1 percent increase in revenue compared to the fourth quarter of 2011, according to an IHS iSuppli DRAM Market Brief report. While this growth may seem marginal, Elpida outperformed the overall DRAM market, which in the third quarter posted sales of $6.2 billion, down 4.4 percent from $6.5 billion in the fourth quarter of 2011, as shown in the table below. Elpida also surpassed its closest competitor, U.S.-based Micron, whose sales declined by 3 percent during the same period, causing it to fall one position to fourth place.

"Elpida?s displacement of Micron for the No. 3 spot is paradoxical, especially as Micron on May 7 won the right to bid exclusively to buy the Japanese company, after Hynix Semiconductor Inc. and Toshiba Corp. dropped out of the bidding race," said Mike Howard, senior principal analyst for DRAM & memory research at IHS. "Because it would derive the most benefit and has the requisite cash to make a deal, Micron was the most logical choice to purchase Elpida, which filed for bankruptcy in February after incurring more than $5 billion in debt and running up a string of quarterly losses."

Micron now must negotiate with Elpida on a number of sensitive issues, including retiring or restructuring the Japanese maker's massive liabilities. Micron must also figure out what to do with Elpida's huge facility in Hiroshima, Japan, especially as the strength of the yen renders manufacturing there uncompetitive.

For Micron, which only in the third quarter last year had captured third place after 20 consecutive quarters in the No. 4 spot, the unhappy return to familiar territory was the result of a 16 percent decline in average selling prices. The drop neutralized the 15 percent gain in the first quarter that the company achieved with its shipments, causing sales for the only U.S.-based DRAM maker to retreat to $759 million, equivalent to 12.2 percent share of the market.

Samsung Electronics and Hynix Semiconductor Inc. remained the Top 2 DRAM manufacturers in the first quarter.

Samsung saw its share diminish slightly to 40.8 percent on sales of $2.5 billion, down sequentially from 43.2 percent. Despite the slippage, Samsung has controlled more than 40 percent of the DRAM market for the last four quarters. The electronics giant is believed to be biding its time to ramp up shipment growth until the end of the year, when DRAM prices are anticipated to be higher.

Meanwhile, runner-up Hynix continued to see its market share climb during the first quarter, reaching its highest level ever at 24.2 percent on sales of $1.5 billion.

Rounding out the Top 5 was Nanya Technology Corp. of Taiwan, which increased its wafer output back to typical levels after throttling production at the end of last year. Nanya increased revenue by an industry-leading 24.2 percent in the first quarter, allowing it to capture 4.5 percent of the DRAM market.