Apple Looked at Samsung and MediaTek For 5G Chips, Apple Executive Says

Apple supply chain executive Tony Blevins said on Friday that Apple has considered MediaTek and rival Samsung to supply the 5G chips for the future iPhones.

The disclosure was made by Tony Blevins on his Friday testimony on the stand at a federal courthouse in San Jose, California, as part of the trial between Qualcomm and the U.S. Federal Trade Commission, Reuters reports.

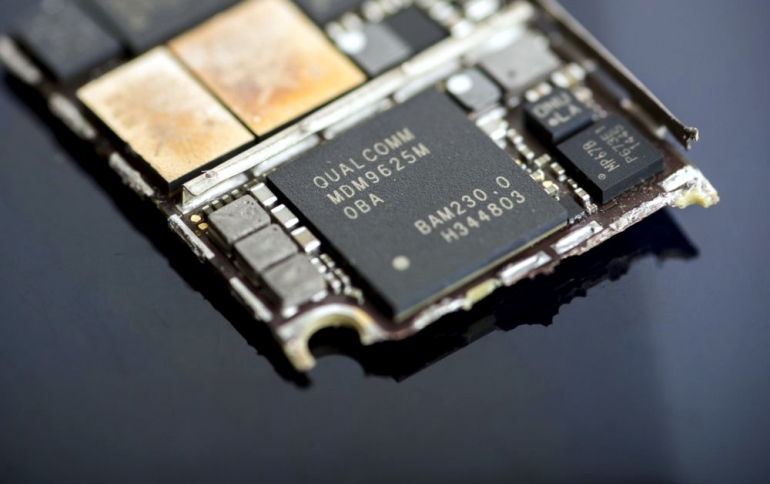

Until 2016, Apple relied on Qualcomm as the sole supplier of modem chips. Starting in 2016, Apple split the business between Intel and Qualcomm. But Apple’s lawsuit against Qualcomm filed in early 2017 caused their business relationship to change, leading to using only Intel’s modems for the phones released last year.

Blevins said that Apple has long sought multiple suppliers for modem chips but the company initially signed an agreement with Qualcomm to exclusively supply the chips because the chip supplier offered deep rebates on patent license costs in exchange for exclusivity.

He added that talking with Samsung, whose Galaxy and Note smartphoness compete against the iPhone, is “not an ideal environment” for Apple, but that Samsung is currently the largest component supplier to Apple.

It is not clear whether Apple had reached a decision on a 5G modem supplier or whether it would release a 5G iPhone in 2019. Accoridng to earlier reports, Apple will not release such a phone until 2020.

Qualcomm defends chip-licensing business

Qualcomm CEO Steve Mollenkopf defended his company's 'no license, no chips' practise, which is at the heart of the government's case against the mobile chipmaker.

Mollenkopf testified that the way his company sells chips to smartphone makers is best for everybody involved. Under Qualcomm's policy, companies must license Qualcomm's patents before it will sell them chips. Apple disagrees with this.

"We only sell to companies with a license because not all the IP [intellectual property] is covered in the chip. What we want to do is make sure the [phone makers] are covered," Mollenkopf said. He pointed to the security framework used when phones connect to a network as an example. "It's not embodied in the chip, it's not in the phones, but it's in all these things," Mollenkopf said. "There's a tremendous amount of iP we generate that makes the system work."

Apple approached Qualcomm about the prospect of exclusively supplying Qualcomm's modem chips in the iPhone in exchange for a $1 billion incentive payment, Mollenkopf testified. Apple did not provide any assurance of how many chips it would buy, said, adding the situation pushed the chip supplier to pursue an exclusivity arrangement in order to ensure it sold enough chips to recover the payment. An incentive payment was made, although the amount hasn't been disclosed.

Qualcomm was not aiming to block rivals like Intel, Mollenkopf said.

“The risk was, what would the volume be? Would we get everything we wanted, given that we paid so much in incentive?” Mollenkopf testified.

"The licensing allows us to invest in technology early. It generates a lot of IP," Mollenkopf said. The company uses the proceeds for research and development into new technologies, he added.

On the contrary, Apple's Tony Blevins offered a very different view of the Apple-Qualcomm partnership in its earlier testimony, as we said previously.

"As we source components, we typically strive to get at least two sources and probably not more than six," he said. "We think competition and market forces are very important to us to achieve the best leverage. With exclusivity, there would be no competition."