Chinese HiSilicon Semi Supplier Appears in Top-10 Semiconductor Suppliers List

HiSilicon, the semiconductor design division of China-based telecommunications giant Huawei, ranked 10th in the 1Q20 IC industry list compiled by IC Insights.

IC Insights will release its May Update to the 2020 McClean Report later this month. This update includes a discussion of the 1Q20 IC industry market results, an updated quarterly forecast for the remainder of this year, and a look at the top-25 1Q20 semiconductor suppliers.

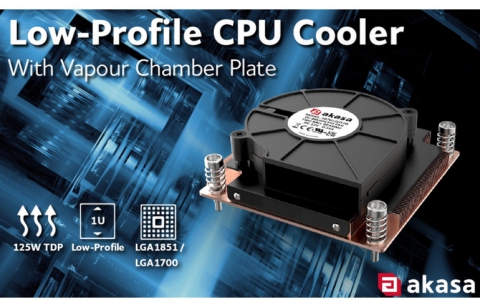

The top-10 worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales ranking for 1Q20 is shown below. It includes six suppliers headquartered in the U.S., two in South Korea, and one each in Taiwan and China. The ranking includes four fabless companies (Broadcom, Qualcomm, Nvidia, and HiSilicon) and one pure-play foundry (TSMC).

In total, the top-10 semiconductor companies’ sales surged by 16% in 1Q20 compared to 1Q19, more than twice the total worldwide semiconductor industry 1Q20/1Q19 increase of 7%. Nine of the top-10 companies had sales of at least $3.0 billion in 1Q20, one company more than in 1Q19. As shown, it took almost $2.7 billion in quarterly sales just to make it into the 1Q20 top-10 semiconductor supplier list.

![]()

There were two new entrants into the top-10 ranking in 1Q20, HiSilicon and Nvidia. These two companies replaced Infineon and Kioxia in the top-10 listing. Over 90% of HiSilicon’s sales go to its parent company, Huawei Technolgies.

As shown, China-based fabless IC supplier HiSilicon jumped up five spots in the ranking to 10th place, making it the first China-based semiconductor supplier to be ranked in the worldwide top-10 listing. HiSilicon’s year-over-year sales surged 54% in 1Q20. Nvidia also posted a solid year-over-year sales increase of 37% in 1Q20.

![]()

The top-10 ranking includes one pure-play foundry, TSMC, which registered a strong 45% 1Q20/1Q19 jump in revenue. Much of this increase was due to a surge in sales of 7nm application processors to Apple and HiSilicon for their respective smartphones.

According to IC Insights, HiSilicon has become an increasingly important customer for TSMC and represented 14% of its sales last year, up from holding only a 5% share in 2017. It is interesting to note that HiSilicon and Apple combined to represent 37% of TSMC’s total sales in 2019.