Computer Storage Market Declines Despite SSD Growth

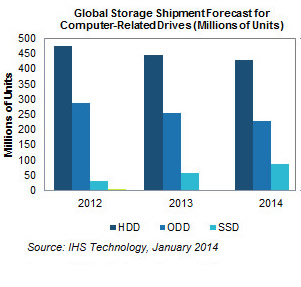

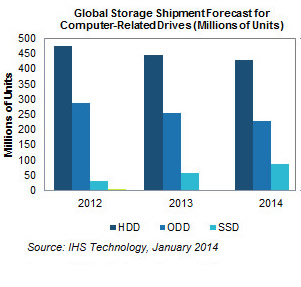

Although the solid-state drive market almost doubled in 2013, the computer-related storage industry slid 5 percent in shipments because of continuing contractions in the hard-disk drive and optical disk drive segments.

Combined shipments worldwide last year for the hard disk drives (HDD), solid-state drives (SSD) and optical disk drives (ODD) making up the computer storage market amounted to 755.0 million units, down from 794.0 million in 2012, according to data released by IHS. While SSD shipments were up an outsize 82 percent to 57.0 million units, both the HDD and ODD segments proved to be a drag. The HDD segment fell 7 percent to 444.4 million units, and the ODD sector did worse with a 12 percent decline to 253.5 million units, the research firm said.

"The storage industry continues to navigate mutliple transitions that are affecting each segment's performance," said Fang Zhang, analyst for storage systems at IHS. "The SSD sector is easily the most promising, compared to a struggling HDD segment that remains huge but is still trying to find its footing in a shifting environment, or to the more beleaguered ODD space that now has become irrelevant."

"The storage industry continues to navigate mutliple transitions that are affecting each segment's performance," said Fang Zhang, analyst for storage systems at IHS. "The SSD sector is easily the most promising, compared to a struggling HDD segment that remains huge but is still trying to find its footing in a shifting environment, or to the more beleaguered ODD space that now has become irrelevant."

The challenge for the storage industry will lie in successfully navigating these changes, Zhang noted, and on how to take advantage of brewing technological trends, such as interest in the cloud, to promote relevant products and offerings.

In the HDD segment, the rise of smartphones and tablets has dented the once-powerful appeal of computers, impacting HDD volume. The losses are especially apparent in the so-called client PC market?the consumer side of the PC business.

Prospects are more promising on the enterprise PC end with businesses starting to undertake a corporate refresh of their computers as the global economy picks up, which should help make up for the decline of the consumer HDD sector.

HDD technologies are also in transition from the current Perpendicular Magnetic Recording method to next-generation mechanisms. Here IHS expects new opportunities to emerge for the HDD industry to meet growing demand for storage in the public and private cloud. More storage will be needed as consumers increase their use of videos, songs, photos and social media.

The HDD industry remains a behemoth on the whole, with shipments for computer-related HDDs averaging 400 million units for the next few years in spite of annual decreases, accounting for approximately half of the entire storage market. Moreover, HDDs will remain the final destination for the majority of digital content, being the cheapest medium on a dollar-per-gigabyte basis compared to other forms of storage media, further ensuring the market's continued viability.

In contrast to the stable but declining HDD market, the SSD industry is in aggressive expansion mode, with favorable drivers for both the short and long term. Improved price points have led to a recent decrease in the cost of SSDs and a resulting higher adoption of the drives by Ultrabooks and similar ultrathin PCs. And new enterprise products, ranging from drives to caches to arrays, have given many I.T. departments greater flexibility to integrate SSDs into corporate storage systems.

The SSD shipments in 2013 were increased by a 82 percent, and IHS estimates that the the market will see volumes rise another 50 percent this year. SSD shipments will then reach 189.6 million units in 2017, close to half the size of the HDD market of 397.0 million.

With consumer PCs forgoing CD disc drives and users favoring video streaming over the use of physical disks, the ODD segment has been unable to stanch a continuous decline of its once-vigorous market.

While the adoption by computers of higher-end ODD technologies such as Blu-ray will help somewhat as the market moves forward, the gains won't make up for the projected larger drop in volume during the next few years, IHS believes. Moreover, the new designs will entail higher costs, putting further pressure on an already weak system. IHS estimates that by 2017, ODD shipments will be down 40 percent from their 2012 levels.

"The storage industry continues to navigate mutliple transitions that are affecting each segment's performance," said Fang Zhang, analyst for storage systems at IHS. "The SSD sector is easily the most promising, compared to a struggling HDD segment that remains huge but is still trying to find its footing in a shifting environment, or to the more beleaguered ODD space that now has become irrelevant."

"The storage industry continues to navigate mutliple transitions that are affecting each segment's performance," said Fang Zhang, analyst for storage systems at IHS. "The SSD sector is easily the most promising, compared to a struggling HDD segment that remains huge but is still trying to find its footing in a shifting environment, or to the more beleaguered ODD space that now has become irrelevant."

The challenge for the storage industry will lie in successfully navigating these changes, Zhang noted, and on how to take advantage of brewing technological trends, such as interest in the cloud, to promote relevant products and offerings.

In the HDD segment, the rise of smartphones and tablets has dented the once-powerful appeal of computers, impacting HDD volume. The losses are especially apparent in the so-called client PC market?the consumer side of the PC business.

Prospects are more promising on the enterprise PC end with businesses starting to undertake a corporate refresh of their computers as the global economy picks up, which should help make up for the decline of the consumer HDD sector.

HDD technologies are also in transition from the current Perpendicular Magnetic Recording method to next-generation mechanisms. Here IHS expects new opportunities to emerge for the HDD industry to meet growing demand for storage in the public and private cloud. More storage will be needed as consumers increase their use of videos, songs, photos and social media.

The HDD industry remains a behemoth on the whole, with shipments for computer-related HDDs averaging 400 million units for the next few years in spite of annual decreases, accounting for approximately half of the entire storage market. Moreover, HDDs will remain the final destination for the majority of digital content, being the cheapest medium on a dollar-per-gigabyte basis compared to other forms of storage media, further ensuring the market's continued viability.

In contrast to the stable but declining HDD market, the SSD industry is in aggressive expansion mode, with favorable drivers for both the short and long term. Improved price points have led to a recent decrease in the cost of SSDs and a resulting higher adoption of the drives by Ultrabooks and similar ultrathin PCs. And new enterprise products, ranging from drives to caches to arrays, have given many I.T. departments greater flexibility to integrate SSDs into corporate storage systems.

The SSD shipments in 2013 were increased by a 82 percent, and IHS estimates that the the market will see volumes rise another 50 percent this year. SSD shipments will then reach 189.6 million units in 2017, close to half the size of the HDD market of 397.0 million.

With consumer PCs forgoing CD disc drives and users favoring video streaming over the use of physical disks, the ODD segment has been unable to stanch a continuous decline of its once-vigorous market.

While the adoption by computers of higher-end ODD technologies such as Blu-ray will help somewhat as the market moves forward, the gains won't make up for the projected larger drop in volume during the next few years, IHS believes. Moreover, the new designs will entail higher costs, putting further pressure on an already weak system. IHS estimates that by 2017, ODD shipments will be down 40 percent from their 2012 levels.