Apple Appeals EU tax Ruling

Apple is challenging a record $14 billion EU tax demand, arguing that EU regulators ignored tax experts and corporate law and deliberately picked a method to maximize the penalty.

The European Commission said on Aug. 30 that Apple's Irish tax deal was illegal state aid and ordered it to repay up to 13 billion euros ($13.8 billion) to Ireland, where Apple has its European headquarters.

European Competition Commissioner Margrethe Vestager, a former Danish economy minister, said Apple's Irish tax bill implied a tax rate of 0.005 percent in 2014.

General Counsel Bruce Sewell and Chief Financial Officer Luca Maestri outlined in an interview with Reuters at Apple's global headquarters in Cupertino the company's plans for its appeal against the Commission's ruling at Europe's second highest court.

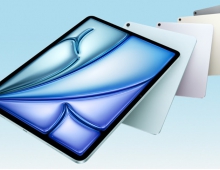

The iPhone and iPad maker was singled out because of its success, Sewell said.

"Apple is not an outlier in any sense that matters to the law. Apple is a convenient target because it generates lots of headlines. It allows the commissioner to become Dane of the year for 2016," he said, referring to the title accorded to Vestager by Danish newspaper Berlingske last month.

Apple will tell judges the Commission was not diligent in its investigation because it disregarded tax experts brought in by Irish authorities.

"Now the Irish have put in an expert opinion from an incredibly well-respected Irish tax lawyer. The Commission not only didn't attack that - didn't argue with it, as far as we know - they probably didn't even read it. Because there is no reference (in the EU decision) whatsoever," Sewell said.

Ireland's tax treatment has allowed Apple to avoid tax on tens of billions of dollars of non-U.S. profit. Over the past 10 years, the company has paid tax at a rate of 3.8 percent on $200 billion of overseas profits, filings show. This is a fraction of the tax rate in the countries where Apple's products are designed, made and sold.