Apple's Shift in Chip Manufacturing Strategy Boosts Semiconductor Foundry Business

In an illustration of the massive power it wields in the electronics supply chain, Apple's migration of the production of key semiconductors from Samsung to pure-play foundries will single-handedly boost the growth of the chip contract manufacturing market this year.

By the end of the year, pure-play semiconductor foundry market revenue is forecast to rise 21 percent compared to 2012, according to an IHS report. In contrast, takings for the overall semiconductor industry will expand by a more staid 5 percent.

The pure-play foundry industry is already on track to achieve such growth this year, with revenue amounting to $8.2 billion in the first quarter, up 4 percent from $7.9 billion in the fourth quarter last year. In comparison, the overall semiconductor market was down by 5 percent during the same period.

The foundry segment is also believed to have outperformed the rest of the industry in the second quarter when final figures are released, and then go on to perform strongly for the second half.

Pure-play foundries are companies that exclusively perform contract manufacturing of chips for other semiconductor suppliers. Major companies in the pure-play foundry business include Taiwan Semiconductor Manufacturing Co. Ltd. and United Microelectronics Corp.

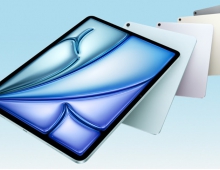

"The growth outlook for the pure-play foundry business has risen considerably in anticipation of Apple's transition of its applications processor chip manufacturing to third-party manufacturers," said Len Jelinek, director and chief analyst of semiconductor manufacturing at IHS. "Previously, Apple had relied on Samsung as the primary supplier of applications processor chips for the iPhone and iPad. However, Samsung is not considered a pure-play foundry. Instead, it is designated as an integrated device manufacturer (IDM)?a chip supplier that not only builds products but also possesses design capabilities and sells devices under its own brand name, functions not performed by foundries."

Apple already has its own designs and does not need an IDM for its chips to be made, so it can just as easily move its semiconductors to a foundry.

"However, Apple's anticipated shift is also the result of its well-publicized tiffs with Samsung over patent infringements on both makers' smartphones that have strained relationships between the two," Jelinek added.

Moving forward, Apple is likely to use a producer like TSMC, the largest foundry in the business, with $16.9 billion in revenue for 2012.

While the overall semiconductor industry continues to be heavily dependent on components sold to the PC market, foundry players have hitched their revenue prospects to the rising fortunes of the wireless segment. As a result, revenue for foundries has been expanding steadily, while that for the overall chip industry has been less assured.

Although strong growth is projected in 2013 for foundry suppliers, several concerns abound that foundry players must monitor throughout the year.

Foundry suppliers must be aware of the global economy, as well as the inventory that their clients maintain. Should the world market sputter, consumer demand for electronic products will weaken, thereby impacting chip makers and foundries alike. If inventory grows out of control for foundry clients as it did in the second half of 2012, manufacturing run rates for foundries could decline significantly for the remaining six months of 2013 as their customers hold back on chip orders.

A rising threat to foundries is also coming from IDMs like Samsung and chipmaker Intel. For the first time, the top foundry suppliers are facing technological competition from IDMs - which means that the leading foundries are no longer in competition with just one another.

As several IDMs attempt to revamp their manufacturing models and move to new and more efficient lithographies, incumbent foundries will be forced to accelerate internal technology development. The race between the two rival groups will result in a shortening of technology cycles and fierce competition among participants. A company unsuccessful in execution will inevitably lose important market share and be weakened, or worse, forced out, IHS believes.

The pure-play foundry industry is already on track to achieve such growth this year, with revenue amounting to $8.2 billion in the first quarter, up 4 percent from $7.9 billion in the fourth quarter last year. In comparison, the overall semiconductor market was down by 5 percent during the same period.

The foundry segment is also believed to have outperformed the rest of the industry in the second quarter when final figures are released, and then go on to perform strongly for the second half.

Pure-play foundries are companies that exclusively perform contract manufacturing of chips for other semiconductor suppliers. Major companies in the pure-play foundry business include Taiwan Semiconductor Manufacturing Co. Ltd. and United Microelectronics Corp.

"The growth outlook for the pure-play foundry business has risen considerably in anticipation of Apple's transition of its applications processor chip manufacturing to third-party manufacturers," said Len Jelinek, director and chief analyst of semiconductor manufacturing at IHS. "Previously, Apple had relied on Samsung as the primary supplier of applications processor chips for the iPhone and iPad. However, Samsung is not considered a pure-play foundry. Instead, it is designated as an integrated device manufacturer (IDM)?a chip supplier that not only builds products but also possesses design capabilities and sells devices under its own brand name, functions not performed by foundries."

Apple already has its own designs and does not need an IDM for its chips to be made, so it can just as easily move its semiconductors to a foundry.

"However, Apple's anticipated shift is also the result of its well-publicized tiffs with Samsung over patent infringements on both makers' smartphones that have strained relationships between the two," Jelinek added.

Moving forward, Apple is likely to use a producer like TSMC, the largest foundry in the business, with $16.9 billion in revenue for 2012.

While the overall semiconductor industry continues to be heavily dependent on components sold to the PC market, foundry players have hitched their revenue prospects to the rising fortunes of the wireless segment. As a result, revenue for foundries has been expanding steadily, while that for the overall chip industry has been less assured.

Although strong growth is projected in 2013 for foundry suppliers, several concerns abound that foundry players must monitor throughout the year.

Foundry suppliers must be aware of the global economy, as well as the inventory that their clients maintain. Should the world market sputter, consumer demand for electronic products will weaken, thereby impacting chip makers and foundries alike. If inventory grows out of control for foundry clients as it did in the second half of 2012, manufacturing run rates for foundries could decline significantly for the remaining six months of 2013 as their customers hold back on chip orders.

A rising threat to foundries is also coming from IDMs like Samsung and chipmaker Intel. For the first time, the top foundry suppliers are facing technological competition from IDMs - which means that the leading foundries are no longer in competition with just one another.

As several IDMs attempt to revamp their manufacturing models and move to new and more efficient lithographies, incumbent foundries will be forced to accelerate internal technology development. The race between the two rival groups will result in a shortening of technology cycles and fierce competition among participants. A company unsuccessful in execution will inevitably lose important market share and be weakened, or worse, forced out, IHS believes.