Lenovo Becomes No. 2 In The PC Market

China's Lenovo overtook Dell to become the world's No. 2 PC maker for the first time, while Hewlett-Packard's personal computer shipments grew 5.3 percent in the third quarter, according to data from two research firms.

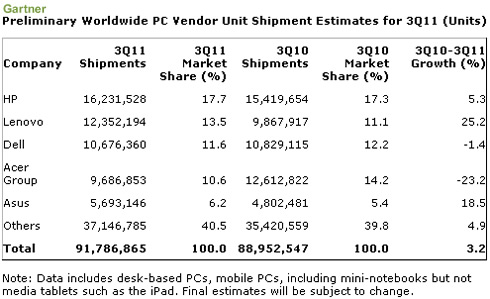

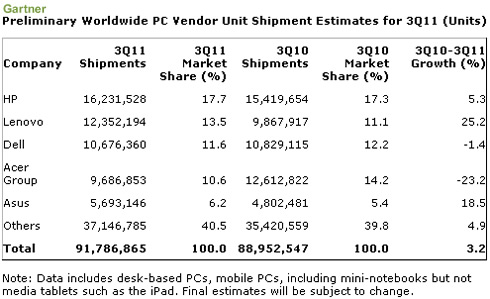

HP now commands a 17.7 percent share of an ailing global market, up marginally from 17.3 percent a year ago, Gartner said. HP has been criticized for management missteps in the past few months, and been affected by slower consumer demand in many regions, but managed to outpace overall market growth nonetheless.

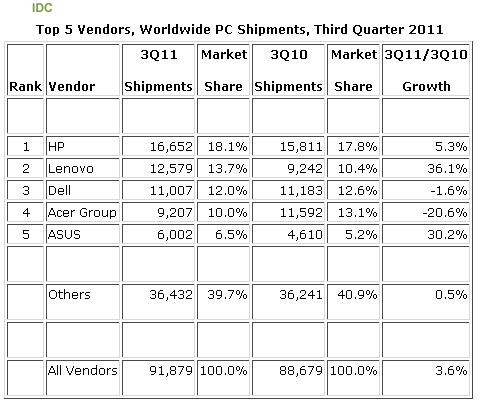

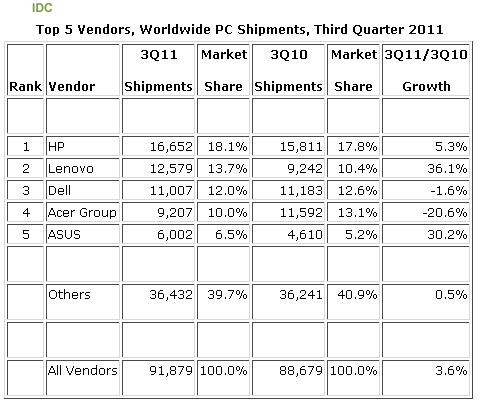

IDC put HP's market share at 18.1 percent. IDC also ranked HP, Lenovo and Dell Nos. 1, 2 and 3.

Lenovo experienced strong gains across all regions as it continues its channel expansion and capitalizes on disarray among the other top players. Lenovo has now outpaced the market by more than 10% for the past 9 quarters, and by 20% or more in six of these periods. The results moved Lenovo ahead of Dell in 3Q11 after trailing by a small margin in the second quarter. Lenovo's partnership with NEC and the acquisition of Medion added incremental volume and provided new access to the Japanese and Western European markets, IDC said.

Dell faced tough competition and had sizable declines in some markets. However, its continued expansion efforts in China continued to pay dividends, maintaining double-digit growth in Asia/Pacific (excluding Japan), IDC added.

Acer continued to struggle with inventory clearing and adjusting its strategy following declines in mini notebooks and its management shake-up. Total shipments were down 20.6% from a year ago - the fourth consecutive quarterly decline.

ASUS had a strong quarter, boosting growth to over 30%. Strong gains in Asia/Pacific, along with improvements in EMEA, helped ASUS overtake Toshiba for the number 5 spot in worldwide shipments. While the vendor has had some difficulties adjusting for the decline in mini notebook PCs, its mainstream notebooks have done well, especially in emerging markets.

Apple Total shipments increased more than 20% in 3Q11, recovering from a dip to 15% growth in the second quarter but otherwise continuing a trend of more than 2 years with over 20% growth. The MacBook Air continues to boost volumes, and Apple's position in driving changes in consumer expectations for devices also positions it favorably relative to other players and tight consumer spending.

"For the moment, PCs have taken a backseat to a range of other devices competing for shrinking consumer and business budgets," said Jay Chou, senior research analyst with IDC's Worldwide Quarterly PC Tracker. "While growth is expected to stay in mid-single digits in the fourth quarter, we should see faster growth in 2012 and beyond based on easier comparisons and refreshed PC offerings as the industry better addresses the evolving usage models by integrating more of the features in ultra mobile devices."

U.S. PC shipments edged up just 1.1 percent to 17.8 million units in the third quarter, according to Gartner. HP expanded its shipments by 15.1 percent in its home market, the firm said.

According to Gartner's data, Lenovo became the second-largest PC vendor in the worldwide market for the first time. The company's expansion was boosted in part by the joint vendor with NEC in Japan.

Dell's performance was below the industry average in most regions, as the company faced intensified competition in the professional space, where Dell has been traditionally strong, Gartner said. Acer mostly cleared its inventory buildup in the EMEA region by the third quarter of 2011. However, channels have been adopting a conservative position in regard to placing orders following the inventory issues. Asus widened the gap with Toshiba, the sixth-largest vendor. Asus achieved strong growth in China.

Dell struggled as shipments declined 7.2 percent in the third quarter of 2011. "Dell's issue has been balancing profitability and market share gain, a difficult task in a PC industry where high volumes and low margins are the norm," Ms. Kitagawa said.

Gartner's early study shows that Apple experienced the strongest growth among the top five vendors in the U.S. PC market. Apple's PC shipments increased 21.5 percent in the third quarter of 2011. The robust growth of the MacBook Air continued to lead Apple's overall growth in the U.S. market.

IDC put HP's market share at 18.1 percent. IDC also ranked HP, Lenovo and Dell Nos. 1, 2 and 3.

Lenovo experienced strong gains across all regions as it continues its channel expansion and capitalizes on disarray among the other top players. Lenovo has now outpaced the market by more than 10% for the past 9 quarters, and by 20% or more in six of these periods. The results moved Lenovo ahead of Dell in 3Q11 after trailing by a small margin in the second quarter. Lenovo's partnership with NEC and the acquisition of Medion added incremental volume and provided new access to the Japanese and Western European markets, IDC said.

Dell faced tough competition and had sizable declines in some markets. However, its continued expansion efforts in China continued to pay dividends, maintaining double-digit growth in Asia/Pacific (excluding Japan), IDC added.

Acer continued to struggle with inventory clearing and adjusting its strategy following declines in mini notebooks and its management shake-up. Total shipments were down 20.6% from a year ago - the fourth consecutive quarterly decline.

ASUS had a strong quarter, boosting growth to over 30%. Strong gains in Asia/Pacific, along with improvements in EMEA, helped ASUS overtake Toshiba for the number 5 spot in worldwide shipments. While the vendor has had some difficulties adjusting for the decline in mini notebook PCs, its mainstream notebooks have done well, especially in emerging markets.

Apple Total shipments increased more than 20% in 3Q11, recovering from a dip to 15% growth in the second quarter but otherwise continuing a trend of more than 2 years with over 20% growth. The MacBook Air continues to boost volumes, and Apple's position in driving changes in consumer expectations for devices also positions it favorably relative to other players and tight consumer spending.

"For the moment, PCs have taken a backseat to a range of other devices competing for shrinking consumer and business budgets," said Jay Chou, senior research analyst with IDC's Worldwide Quarterly PC Tracker. "While growth is expected to stay in mid-single digits in the fourth quarter, we should see faster growth in 2012 and beyond based on easier comparisons and refreshed PC offerings as the industry better addresses the evolving usage models by integrating more of the features in ultra mobile devices."

U.S. PC shipments edged up just 1.1 percent to 17.8 million units in the third quarter, according to Gartner. HP expanded its shipments by 15.1 percent in its home market, the firm said.

According to Gartner's data, Lenovo became the second-largest PC vendor in the worldwide market for the first time. The company's expansion was boosted in part by the joint vendor with NEC in Japan.

Dell's performance was below the industry average in most regions, as the company faced intensified competition in the professional space, where Dell has been traditionally strong, Gartner said. Acer mostly cleared its inventory buildup in the EMEA region by the third quarter of 2011. However, channels have been adopting a conservative position in regard to placing orders following the inventory issues. Asus widened the gap with Toshiba, the sixth-largest vendor. Asus achieved strong growth in China.

Dell struggled as shipments declined 7.2 percent in the third quarter of 2011. "Dell's issue has been balancing profitability and market share gain, a difficult task in a PC industry where high volumes and low margins are the norm," Ms. Kitagawa said.

Gartner's early study shows that Apple experienced the strongest growth among the top five vendors in the U.S. PC market. Apple's PC shipments increased 21.5 percent in the third quarter of 2011. The robust growth of the MacBook Air continued to lead Apple's overall growth in the U.S. market.