RIM and Apple Displace Motorola

Research In Motion (RIM) and Apple in the first quarter rose to the fifth and sixth positions in the global market for all types of cell phones, while Motorola fell to eighth place, according to iSupply.

RIM, whose cell phone line consists entirely of Blackberry smart phone devices, achieved the best results of the Top 10 cell phone brands in the first quarter, with its shipments rising by 364,000 units or 3.6 percent compared to the fourth quarter of 2009, the research firm said. This defied the industrywide slowdown and caused the company's rank to rise to No. 5 in the global cell phone market, up from eighth place in the fourth quarter of 2009.

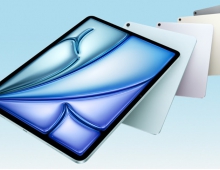

Apple in the first quarter shipped 8.8 million mobile handsets, every one an iPhone, giving it a 3.04 percent share of global shipments. Company shipments rose by 0.2 percent from 8.7 million in the fourth quarter of 2009, giving it the No. 6 position in the market in the first quarter, up from ninth place in the fourth quarter of 2009. Apple achieved the second-largest sequential increase in shipments among the Top 10 brands.

RIM and Apple were the only smart phone brands among the Top 10 to achieve sequential quarterly growth.

In contrast, Motorola in the first quarter posted a 29.2 percent decline in shipments to 8.5 million units, down from 12 million in the fourth quarter of 2009. This caused the company's rank to slide two positions to eighth place, falling behind both Apple and Chinese handset OEM ZTE Co. Ltd.

The rise of the smart-phone-oriented players - and the reduction in shipments of a former leader famous for its mass-market cell phone products - illustrates the changing conditions in the wireless business?and the changing strategies of the leading players in the market.

"Smart phones represent the hottest segment of the cell phone market, with unit shipment growth of 35.5 percent expected in 2010, compared to 11.3 percent for the overall mobile handset business," noted Tina Teng, senior analyst, wireless communications, for iSuppli. "Because of this, companies that are exclusively focused on this area, like RIM and Apple, have managed to move up to near the top-tier of the global cell phone business. This shows that the smart phone is reshaping the competitive landscape of the wireless business."

Because of its difficulties in offering compelling new models following the success of the RAZR, Motorola's share of global cell phone shipments has been sliding over the past three years. As recently as the first quarter of 2007, Motorola was the world's second largest cell phone shipper after Nokia.

However, while Motorola's unit shipments continued to slide in the first quarter, this decline now reflects the company's strategic decision to shift its focus away from low-margin, mass-market cell phones and toward higher-profit products like the Droid and Backflip.

"While Motorola's ranking and share declined in the first quarter, the company did manage to make significant improvement in profit during the period, with its margin rising by 19 percentage points compared to the first quarter of 2009," Teng noted. "This shows that Motorola is on the right track in its product mix, focusing on more profitable devices like Droid. As the company works to transition its product line to smart phones tailored for social networking activities, and to reduce sales of lower-priced, lower-margin models, it stands to further enhance its profitability - and perhaps reclaim some market share."

The advance of smart-phone-oriented brands in the mobile handset business may not be over yet.

"RIM is now within a hair?s breadth of displacing Sony Ericsson for the No. 3 rank in the global cell phone market," Teng observed. "It will be interesting to see how much more market share RIM and Apple can gain in 2010."

Following normal seasonal patterns, worldwide cell phone shipments declined in the first quarter compared to the fourth quarter of 2009. Shipments declined to 288.1 million units, down 13.9 percent from 334.6 million in the fourth quarter. However, first-quarter shipments soared by 13.8 percent compared to the same period in 2009, providing a very optimistic indicator of market growth this year.

The Top 4 players in the first quarter retained their rankings compared to the fourth quarter. Among the Top 4, only No. 2 Samsung Electronics Co. Ltd. was able to perform better than the industry average with only a 6.5 percent sequential decline in revenue.

No. 1 Nokia's market share in the first quarter slipped to 37.4 percent, down slightly from 37.9 percent during the same period in 2009, as its shipments declined by 15.1 percent sequentially. Samsung's limited decline in shipments allowed the company to increase its market share to 22.3 percent in the first quarter, compared to 20.6 percent during the same period in 2009. With its relatively strong performance, Samsung has managed to close the market share gap with Nokia to just 15.1 points, down from 17.4 points in the fourth quarter of 2009.

No. 3-ranked LG Electronics suffered a 20.1 decline in revenue, causing its market share to decrease to 9.4 percent, down from 10.1 percent during the fourth quarter of 2009, widening its gap with Samsung as a result. Sony Ericsson in fourth place suffered a 28.1 percent decline in shipments, causing its share to decline to 3.6 percent, down from 4.4 percent during the fourth quarter of 2009.

Although ZTE sprinted like a marathon runner in 2009 and grabbed the No. 5 slot in the fourth quarter of the year, its revenue in the first quarter fell 35.6 percent sequentially, causing it to fall behind Apple in market-share rankings to seventh place.

Apple in the first quarter shipped 8.8 million mobile handsets, every one an iPhone, giving it a 3.04 percent share of global shipments. Company shipments rose by 0.2 percent from 8.7 million in the fourth quarter of 2009, giving it the No. 6 position in the market in the first quarter, up from ninth place in the fourth quarter of 2009. Apple achieved the second-largest sequential increase in shipments among the Top 10 brands.

RIM and Apple were the only smart phone brands among the Top 10 to achieve sequential quarterly growth.

In contrast, Motorola in the first quarter posted a 29.2 percent decline in shipments to 8.5 million units, down from 12 million in the fourth quarter of 2009. This caused the company's rank to slide two positions to eighth place, falling behind both Apple and Chinese handset OEM ZTE Co. Ltd.

The rise of the smart-phone-oriented players - and the reduction in shipments of a former leader famous for its mass-market cell phone products - illustrates the changing conditions in the wireless business?and the changing strategies of the leading players in the market.

"Smart phones represent the hottest segment of the cell phone market, with unit shipment growth of 35.5 percent expected in 2010, compared to 11.3 percent for the overall mobile handset business," noted Tina Teng, senior analyst, wireless communications, for iSuppli. "Because of this, companies that are exclusively focused on this area, like RIM and Apple, have managed to move up to near the top-tier of the global cell phone business. This shows that the smart phone is reshaping the competitive landscape of the wireless business."

Because of its difficulties in offering compelling new models following the success of the RAZR, Motorola's share of global cell phone shipments has been sliding over the past three years. As recently as the first quarter of 2007, Motorola was the world's second largest cell phone shipper after Nokia.

However, while Motorola's unit shipments continued to slide in the first quarter, this decline now reflects the company's strategic decision to shift its focus away from low-margin, mass-market cell phones and toward higher-profit products like the Droid and Backflip.

"While Motorola's ranking and share declined in the first quarter, the company did manage to make significant improvement in profit during the period, with its margin rising by 19 percentage points compared to the first quarter of 2009," Teng noted. "This shows that Motorola is on the right track in its product mix, focusing on more profitable devices like Droid. As the company works to transition its product line to smart phones tailored for social networking activities, and to reduce sales of lower-priced, lower-margin models, it stands to further enhance its profitability - and perhaps reclaim some market share."

The advance of smart-phone-oriented brands in the mobile handset business may not be over yet.

"RIM is now within a hair?s breadth of displacing Sony Ericsson for the No. 3 rank in the global cell phone market," Teng observed. "It will be interesting to see how much more market share RIM and Apple can gain in 2010."

Following normal seasonal patterns, worldwide cell phone shipments declined in the first quarter compared to the fourth quarter of 2009. Shipments declined to 288.1 million units, down 13.9 percent from 334.6 million in the fourth quarter. However, first-quarter shipments soared by 13.8 percent compared to the same period in 2009, providing a very optimistic indicator of market growth this year.

The Top 4 players in the first quarter retained their rankings compared to the fourth quarter. Among the Top 4, only No. 2 Samsung Electronics Co. Ltd. was able to perform better than the industry average with only a 6.5 percent sequential decline in revenue.

No. 1 Nokia's market share in the first quarter slipped to 37.4 percent, down slightly from 37.9 percent during the same period in 2009, as its shipments declined by 15.1 percent sequentially. Samsung's limited decline in shipments allowed the company to increase its market share to 22.3 percent in the first quarter, compared to 20.6 percent during the same period in 2009. With its relatively strong performance, Samsung has managed to close the market share gap with Nokia to just 15.1 points, down from 17.4 points in the fourth quarter of 2009.

No. 3-ranked LG Electronics suffered a 20.1 decline in revenue, causing its market share to decrease to 9.4 percent, down from 10.1 percent during the fourth quarter of 2009, widening its gap with Samsung as a result. Sony Ericsson in fourth place suffered a 28.1 percent decline in shipments, causing its share to decline to 3.6 percent, down from 4.4 percent during the fourth quarter of 2009.

Although ZTE sprinted like a marathon runner in 2009 and grabbed the No. 5 slot in the fourth quarter of the year, its revenue in the first quarter fell 35.6 percent sequentially, causing it to fall behind Apple in market-share rankings to seventh place.