Yahoo Seeks AOL Tie; Microsoft In Talks With News Corp

While Yahoo seems be running out of alternatives to accepting Microsoft's takeover offer, the company has become a target of two warring camps of technology giants and their media allies, sources said on Wednesday.

News Corp is considering joining Microsoft in a bid for Yahoo which would bring in News Corp's MySpace online social hangout and create a more formidable rival to Google, newspaper reports said onm Wednesday.

But Yahoo, which announced earlier on Wednesday it plans to test Google search ads alongside Yahoo Web search services, is closing in on a deal with Time Warner with its AOL unit.

Reports were sketchy on exactly how a Microsoft deal with News Corp might be structured, making it difficult for Wall Street analysts to say which combination might prove the superior offer. Several said Yahoo has regained some of the negotiating momentum it appeared to have lost with Microsoft.

Yahoo's talks with Time Warner are getting near to a deal that would fold AOL's business, excluding its legacy dial-up Internet access operations, into a combined Yahoo company. Such a deal would value AOL at $10 billion.

The New York Times reported that Microsoft had begun talks to bring News Corp in on its effort to acquire Yahoo.

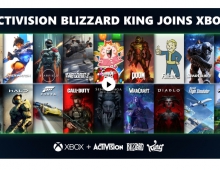

This combination would bring together three of the biggest Web site publishers on the Internet: Yahoo, Microsoft's MSN and News Corp's MySpace.

Yahoo said it was beginning a two-week test on whether it can use Google to sell ads alongside Yahoo Web search services. The initial test is small, covering only 3 percent of Web searches performed on Yahoo, the companies said.

However, the tests could lead Yahoo to a broader deal in which it lets Google sell search advertising for it in order for Yahoo to concentrate on online brand ads.

Commenting on Yahoo's announcement regarding Microsoft's letter to Yahoo's board members last week, Microsoft siad:

"Any definitive agreement between Yahoo! and Google would consolidate over 90% of the search advertising market in Google?s hands. This would make the market far less competitive, in sharp contrast to our own proposal to acquire Yahoo! We will assess closely all of our options. Our proposal remains the only alternative put forward that offers Yahoo! shareholders full and fair value for their shares, gives every shareholder a vote on the future of the company, and enhances choice for content creators, advertisers, and consumers."

Microsoft had threatened on Saturday to launch a hostile bid for Yahoo and could lower its offer in about three weeks if it does not get a deal from Yahoo, a Web pioneer which argues it is worth more than Microsoft's $42 billion bid.

Any of the combinations, or another yet to be determined, would fundamentally change the Web. Major players have been circling each other as the first decade of growth in the Internet market has begun to slow dramatically.

But Yahoo, which announced earlier on Wednesday it plans to test Google search ads alongside Yahoo Web search services, is closing in on a deal with Time Warner with its AOL unit.

Reports were sketchy on exactly how a Microsoft deal with News Corp might be structured, making it difficult for Wall Street analysts to say which combination might prove the superior offer. Several said Yahoo has regained some of the negotiating momentum it appeared to have lost with Microsoft.

Yahoo's talks with Time Warner are getting near to a deal that would fold AOL's business, excluding its legacy dial-up Internet access operations, into a combined Yahoo company. Such a deal would value AOL at $10 billion.

The New York Times reported that Microsoft had begun talks to bring News Corp in on its effort to acquire Yahoo.

This combination would bring together three of the biggest Web site publishers on the Internet: Yahoo, Microsoft's MSN and News Corp's MySpace.

Yahoo said it was beginning a two-week test on whether it can use Google to sell ads alongside Yahoo Web search services. The initial test is small, covering only 3 percent of Web searches performed on Yahoo, the companies said.

However, the tests could lead Yahoo to a broader deal in which it lets Google sell search advertising for it in order for Yahoo to concentrate on online brand ads.

Commenting on Yahoo's announcement regarding Microsoft's letter to Yahoo's board members last week, Microsoft siad:

"Any definitive agreement between Yahoo! and Google would consolidate over 90% of the search advertising market in Google?s hands. This would make the market far less competitive, in sharp contrast to our own proposal to acquire Yahoo! We will assess closely all of our options. Our proposal remains the only alternative put forward that offers Yahoo! shareholders full and fair value for their shares, gives every shareholder a vote on the future of the company, and enhances choice for content creators, advertisers, and consumers."

Microsoft had threatened on Saturday to launch a hostile bid for Yahoo and could lower its offer in about three weeks if it does not get a deal from Yahoo, a Web pioneer which argues it is worth more than Microsoft's $42 billion bid.

Any of the combinations, or another yet to be determined, would fundamentally change the Web. Major players have been circling each other as the first decade of growth in the Internet market has begun to slow dramatically.