Western Digital Takes Top Spot in Hard Drive Shipments

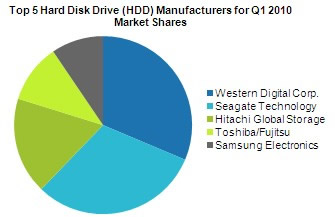

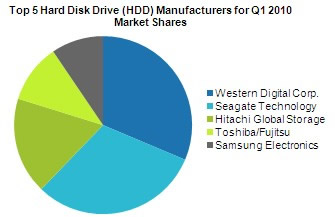

Western Digital Corp. in the first quarter of 2010 shipped the most Hard Disk Drives (HDD) of any storage supplier, surpassing arch nemesis Seagate Technology for the first time ever on a quarterly basis, according to iSuppli Corp.

Western Digital shipped a record 51.1 million HDDs during the period, up 3.2 percent from 49.5 million in the fourth quarter of 2009. In comparison, Seagate's HDD shipments amounted to 50.3 million units in the first quarter of 2010, up 0.8 percent from 49.9 million during the previous quarter.

While Western Digital's remarkable feat succeeded in finally ending the long-running perch at the top for its rival in terms of shipments, Seagate continued to lead on the revenue front at $3.1 billion, compared to Western Digital?s $2.64 billion, iSuppli data show.

Rounding out the Top 5 in HDD shipments for the first quarter of 2010 were Hitachi Global Storage Technologies in third place, Toshiba/Fujitsu in fourth and Samsung Electronics Co. Ltd. in fifth. All three companies retained their rankings from the previous quarter. However, while Hitachi showed the strongest quarter-over-quarter growth among the Top 5, up 13.9 percent during the period, both Toshiba/Fujitsu and Samsung registered shipment declines.

"Despite the switch in the shipment rankings, the head-to-head competition between the two giants will Seagate Technology continue, and Seagate will experience pressure from Western Digital in the battle for the top market position in the future," said Fang Zhang, analyst for storage systems at iSuppli. "While the low-cost model might cost Western Digital some revenue, that same approach will be the company's point of leverage in its quest to pick up more business so that it can undermine Seagate, iSuppli believes.

"Which company will take - or keep - the No. 1 position in the future will depend on a number of critical factors, including product competitiveness in the market, new product offerings, success in maintaining existing business while being able to penetrate new markets and capability to control demand and supply without jeopardizing or losing potential opportunities.

In the meantime, both Seagate and Western Digital continue to operate under tight capacity, with the situation easing somewhat in the second quarter due to slight seasonal declines in overall shipments."

Furthermore, various HDD companies have stated their plans to increase capital spending this year, iSuppli said. Western Digital said it will spend $1.2 billion during the next five years on its plants in Malaysia?a figure considerably higher than the $650 million to $750 million in general that the company had allotted in 2010. Likewise, increased capital expenditures have been announced by the likes of Toshiba Corp., Samsung Electronics Co. Ltd. and Hitachi Corp. Because of the augmented capital expenditures from HDD manufacturers, the industry can be expected to maintain a balance between supply and demand in 2010, iSuppli anticipates.

While Western Digital's remarkable feat succeeded in finally ending the long-running perch at the top for its rival in terms of shipments, Seagate continued to lead on the revenue front at $3.1 billion, compared to Western Digital?s $2.64 billion, iSuppli data show.

Rounding out the Top 5 in HDD shipments for the first quarter of 2010 were Hitachi Global Storage Technologies in third place, Toshiba/Fujitsu in fourth and Samsung Electronics Co. Ltd. in fifth. All three companies retained their rankings from the previous quarter. However, while Hitachi showed the strongest quarter-over-quarter growth among the Top 5, up 13.9 percent during the period, both Toshiba/Fujitsu and Samsung registered shipment declines.

"Despite the switch in the shipment rankings, the head-to-head competition between the two giants will Seagate Technology continue, and Seagate will experience pressure from Western Digital in the battle for the top market position in the future," said Fang Zhang, analyst for storage systems at iSuppli. "While the low-cost model might cost Western Digital some revenue, that same approach will be the company's point of leverage in its quest to pick up more business so that it can undermine Seagate, iSuppli believes.

"Which company will take - or keep - the No. 1 position in the future will depend on a number of critical factors, including product competitiveness in the market, new product offerings, success in maintaining existing business while being able to penetrate new markets and capability to control demand and supply without jeopardizing or losing potential opportunities.

In the meantime, both Seagate and Western Digital continue to operate under tight capacity, with the situation easing somewhat in the second quarter due to slight seasonal declines in overall shipments."

Furthermore, various HDD companies have stated their plans to increase capital spending this year, iSuppli said. Western Digital said it will spend $1.2 billion during the next five years on its plants in Malaysia?a figure considerably higher than the $650 million to $750 million in general that the company had allotted in 2010. Likewise, increased capital expenditures have been announced by the likes of Toshiba Corp., Samsung Electronics Co. Ltd. and Hitachi Corp. Because of the augmented capital expenditures from HDD manufacturers, the industry can be expected to maintain a balance between supply and demand in 2010, iSuppli anticipates.