TSMC Forecasts Slow Sales Amid Smartphone Slowdown

Taiwan Semiconductor Manufacturing Co. forecast second-quarter sales below estimates as slower smartphone demand and sliding personal computer shipments hit revenue. Sales will be between NT$215 billion ($6.6 billion) and NT$218 billion in the second quarter, the world’s largest contract maker of microchips said Thursday.

The company also reported first-quarter results Thursday, with net income slumping 18 percent to NT$64.8 billion.

"Although the February 6 earthquake caused some delay in wafer shipments in the first quarter, we saw business upside resulting from demand increases in mid- and low-end smartphone segments and customer inventory restocking," said Lora Ho, SVP and Chief Financial Officer of TSMC. "We expect our business in the second quarter will benefit from continued inventory restocking and recovery of the delayed shipments from the earthquake."

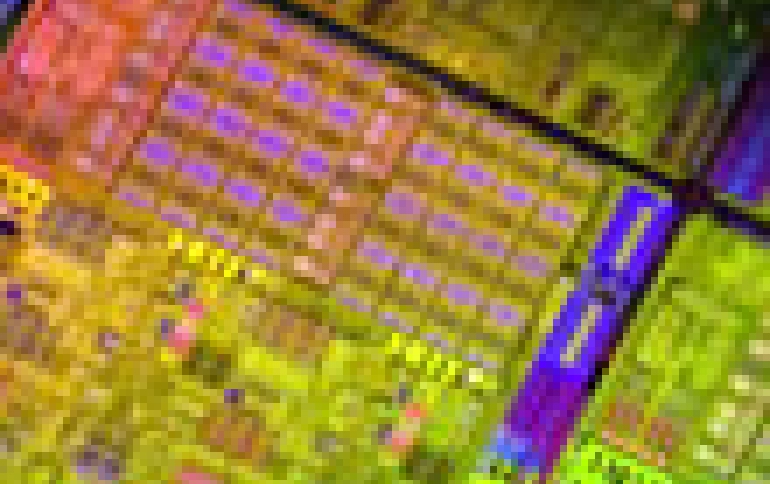

Shipments of 16/20nm accounted for 23% of TSMC's total wafer revenues in the first quarter of 2016, the company disclosed. Advanced technologies, defined as 28nm and more advanced technologies, accounted for 53% of the foundry's total wafer revenues in the first quarter compared with 49% in the prior quarter and 46% a year earlier.