TSMC to Build Arizona Chip Plant

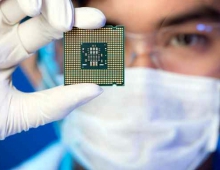

TSMC today announced its intention to build and operate an advanced semiconductor fab in the United States with the mutual understanding and commitment to support from the U.S. federal government and the State of Arizona.

This facility, which will be built in Arizona, will utilize TSMC’s 5-nanometer technology for semiconductor wafer fabrication, have a 20,000 semiconductor wafer per month capacity, create over 1,600 high-tech professional jobs directly, and thousands of indirect jobs in the semiconductor ecosystem. Construction is planned to start in 2021 with production targeted to begin in 2024. TSMC’s total spending on this project, including capital expenditure, will be approximately US$12 billion from 2021 to 2029.

"This U.S. facility not only enables us to better support our customers and partners, it also gives us more opportunities to attract global talents. This project is of critical, strategic importance to a vibrant and competitive U.S. semiconductor ecosystem that enables leading U.S. companies to fabricate their cutting-edge semiconductor products within the United States and benefit from the proximity of a world-class semiconductor foundry and ecosystem," TSMC said.

In the United States, TSMC currently operates a fab in Camas, Washington and design centers in both Austin, Texas and San Jose, California. The Arizona facility would be TSMC’s second manufacturing site in the United States.

The plan comes as U.S. President Donald Trump steps up criticism of Chinese trade practices and Beijing’s handling of the novel coronavirus ahead of the Nov. 3 U.S. presidential election.

Trump has long pledged to bring manufacturing back from overseas and now a steep economic slump brought on by the coronavirus is driving a government-wide push to end U.S. production and supply chain dependency on China.

A U.S. Commerce Department official said TSMC’s decision to locate the plant in the United States generated “good will” at the department, the drafter of a law that would, if implemented, severely restrict TSMC chip sales to Huawei.

The Trump administration has been also in talks with Intel to build a plant in the United States, and Intel said last week it was in discussions with the Department of Defense about improving domestic sources for microelectronics and related technology.

TSMC currently operates 12 fabs in total, including 6-inch, 8-inch, and 12-inch wafer fabs; its 12-inch wafer capacity sits at about 800k wafer starts per month. The company’s sole U.S.-based 8-inch fab is located in Camas, Washington, with a monthly capacity of 40k wafer starts, which occupies about 1-2% of TSMC’s overall wafer capacity.

In the early stages of the China-U.S. trade war, the U.S. government began considering the possibility of localized semiconductor manufacturing due to national security concerns. Although Intel operates several manufacturing sites in the U.S., TSMC holds a distinct technical advantage in terms of advanced process technology, which has encouraged the U.S. government to give TSMC priority as a potential semiconductor partner. However, constructing a fab in the U.S. involves many complex processes, and wafer starts from the U.S. government’s national defense contracts alone cannot sustain entire business operations for a 12-inch fab. As such, ensuring the completeness of the overall supply chain and buiness models remains the most important consideration for TSMC going forward.

TSMC could partially shift certain high-gross margin wafer start orders placed by U.S. companies to its U.S.-based fabs. Nevertheless, in spite of TSMC’s existing 8-inch wafer fab in the U.S., the company has to handle the fact that 12-inch fabs require different supply chains compared to 8-inch fabs. That is why TSMC’s project in Arizona may also involve other Taiwanese suppliers of semiconductor-related raw materials or even components moving their production to the U.S. as well. In the long-run, TSMC’s development will help move the possibility of U.S.-based semiconductor manufacturing one step closer to reality.