Memory Prices To Raise Due To Tight Supply

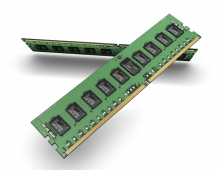

Memory chipmakers and analysts predict that the average price of benchmark memory chips rose 26 to 31 percent last year and that it will continue this year as supplies remain tight.

"We expect an ultra-super-cycle instead of just a super-cycle in the 2017 DRAM industry," said CW Chung, an analyst at Nomura Securities, referring to memory chips used in smartphones and computers for short-term data processing and storage.

Gadget makers are trying to secure stable supplies, and distributors reporting shipment delays, while chipmakers enjoy bumper earnings.

"As of the end of the fourth quarter, our DRAM inventory in particular has gotten tight compared to the previous period after we actively responded to demand," said Chun Se-won, a senior vice president at Samsung Electronics.

BNP Paribas SA estimates the industry-wide inventory of NAND flash memory chips, used for longer-term data storage, is also less than one week.

Toshiba said it is receiving orders beyond its capacity for NAND chips, and SK Hynix, while meeting orders for now, warned that an industry-wide shortage of NAND chips will likely persist this year.

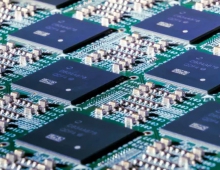

Samsung appears best placed to benefit from the market cycle given its early and heavy investment in 3D NAND chips, which are in demand from high-end storage products used in data servers.

SK Hynix says it is still a year behind Samsung in this technology, but hopes to close the gap this year. Toshiba said it is still months behind Samsung in producing 3D NAND chips.