UMC Sees Decrease In 4Q12 Chip Shipments

United Microelectronics (UMC) saw its revenues increase about 3% sequentially in the third quarter of 2012. However, the company expects to post another shipment drop sequentially in the fourth quarter.

UMC saw its revenues increase about 3% sequentially in the third quarter of 2012, despite having lower shipments for the quarter, according to the foundry chipmaker. However, UMC's wafer shipments for the fourth quarter are set to decrease 7-9% sequentially, with ASPs up about 2%, the foundry indicated.

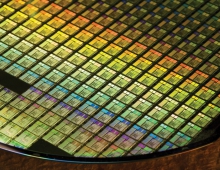

UMC announced third-quarter revenues of NT$28.5 billion (US$973.22 million), up 3.3% on quarter and 13.3% on year. Sales generated from 40nm process technology accounted for 13% of company revenues in the third quarter.

The foundry shipped about 1.13 billion 8-inch equivalent wafers in the third quarter, down from 1.14 billion in the prior quarter but up from the 1.025 million shipped in third-quarter 2011.

"In 3Q 2012, both UMC's revenue and operating profit continued to grow. Wafer shipments reached 1.13 million 8-inch equivalent wafers, with overall capacity utilization at 84%. Increased 40nm revenue contribution led to higher average selling price, which contributed to 3Q revenue growth. With the share of 40nm sales growing from 9% to 13% quarter-over-quarter due to solid 40nm chip demand, we anticipate our 15% year-end internal revenue target from 40nm to be achieved ahead of schedule," Dr. Shih-Wei Sun, CEO of UMC, said.

In addition to 40nm, UMC is providing embedded flash specialty technologies for the rising touch-sensor chipset market. The company hopes that these specialty technologies would inject UMC with new growth momentum in the coming future.

Dr.Sun added that the company's 28nm yield has been significantly improved. UMC also successfully taped out a mobile communication product in 3Q using its 28nm high-k/-metal-gate (gate-last) process. Meanwhile, based on the company's IBM FinFET licensing, UMC has decided to aggressively develop 14nm FinFET technology on 20nm metal. Dr.Sun expects 14nm FinFET will deliver "the most optimal low-power and high-performance solution to offset the cost impact from using double patterning lithography."

Rival TSMC saw shipments of 28nm process technology more than double during the third quarter to account for 13% of the foundry's total wafer sales. The sales proportion is forecast to exceed 20% in the fourth quarter.

UMC also expects the present inventory adjustment to continue into early next year, with recovery to be expected in 2013.

"We expect the present inventory adjustment to continue into early next year. The momentum of the demand recovery in 2013 will be determined by macroeconomic conditions, end demand strength and the transition progress for new products entering the market," Sun continued.

UMC announced third-quarter revenues of NT$28.5 billion (US$973.22 million), up 3.3% on quarter and 13.3% on year. Sales generated from 40nm process technology accounted for 13% of company revenues in the third quarter.

The foundry shipped about 1.13 billion 8-inch equivalent wafers in the third quarter, down from 1.14 billion in the prior quarter but up from the 1.025 million shipped in third-quarter 2011.

"In 3Q 2012, both UMC's revenue and operating profit continued to grow. Wafer shipments reached 1.13 million 8-inch equivalent wafers, with overall capacity utilization at 84%. Increased 40nm revenue contribution led to higher average selling price, which contributed to 3Q revenue growth. With the share of 40nm sales growing from 9% to 13% quarter-over-quarter due to solid 40nm chip demand, we anticipate our 15% year-end internal revenue target from 40nm to be achieved ahead of schedule," Dr. Shih-Wei Sun, CEO of UMC, said.

In addition to 40nm, UMC is providing embedded flash specialty technologies for the rising touch-sensor chipset market. The company hopes that these specialty technologies would inject UMC with new growth momentum in the coming future.

Dr.Sun added that the company's 28nm yield has been significantly improved. UMC also successfully taped out a mobile communication product in 3Q using its 28nm high-k/-metal-gate (gate-last) process. Meanwhile, based on the company's IBM FinFET licensing, UMC has decided to aggressively develop 14nm FinFET technology on 20nm metal. Dr.Sun expects 14nm FinFET will deliver "the most optimal low-power and high-performance solution to offset the cost impact from using double patterning lithography."

Rival TSMC saw shipments of 28nm process technology more than double during the third quarter to account for 13% of the foundry's total wafer sales. The sales proportion is forecast to exceed 20% in the fourth quarter.

UMC also expects the present inventory adjustment to continue into early next year, with recovery to be expected in 2013.

"We expect the present inventory adjustment to continue into early next year. The momentum of the demand recovery in 2013 will be determined by macroeconomic conditions, end demand strength and the transition progress for new products entering the market," Sun continued.