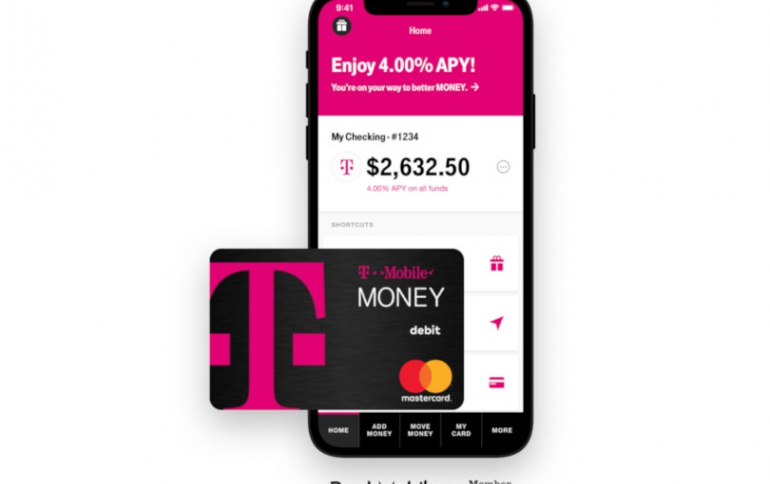

T-Mobile Launches T-Mobile MONEY App Checking Account

T-Mobile has launched T-Mobile MONEY in the U.S., a a no-fee, interest-earning, mobile-first checking account that anyone can open and manage right from their smartphone.

With T-Mobile MONEY, monthly wireless subscribers who deposit at least $200 a month will be able to get 4 percent interest on up to $3,000, and 1 percent interest on sums above that.

With the app, you can make mobile check deposits, set up direct deposit, pay bills, send a check, pay with a mobile wallet such as Apple Pay, Google Pay and Samsung Pay, transfer money, even make payments person to person. The app offers biometric security with fingerprint and Face ID login, account alerts and debit card disabling. It also lets customer overdraw their account up to $50 with no fees if the amount is paid within 30 days.

Plus, T-Mobile MONEY comes with a Mastercard debit card you can use at Allpoint ATMs worldwide. And you can use the T-Mobile MONEY app or web site to locate the ATM nearest you. Plus, your T-Mobile MONEY Mastercard offers Mastercard Zero Liability Protection.

T-Mobile created the app in partnership with BankMobile, a division of Customers Bank (Member FDIC), and has been available in a limited pilot since November 2018. T-Mobile MONEY deposits are FDIC-insured up to $250,000.

The approach pits T-Mobile against banks, which may be offering lower interest and less functionality in their mobile apps. But T-Mobile hopes to gain an edge by making the process easy.

T-Mobile is trying idea is to keep customers loyal in a market where it is battling two much-larger competitors, Verizon Communications Inc. and AT&T Inc. The carrier also is trying to get regulators to approve its $26 billion takeover of Sprint, and showing that it has innovative services.