Chip Gear-Maker ASML Offers Positive Sales Forecast

ASML Holding NV, Europe's largest semiconductor-equipment maker, has won orders for six more of its newest lithography machines in the fourth quarter.

First-quarter revenue will be about 1.8 billion euros ($1.9 billion), Veldhoven, Netherlands-based ASML predicts.

"2016 has been a remarkable year for ASML on many fronts. We delivered record financial performance, with contributions from each of our wide range of product offerings, notably Deep Ultraviolet (DUV) and Holistic Lithography. It was also the year when the industry turned the corner on the introduction of EUV. We laid the foundation for further expansion of our pattern fidelity strategy with the acquisition of Hermes Microvision Inc. We strengthened our partnership with Zeiss by agreeing to acquire a minority stake in Carl Zeiss SMT to secure the extension of EUV beyond the next decade. All of this has further anchored our leadership position in the semiconductor equipment market," ASML President and Chief Executive Officer Peter Wennink said.

"Logic chip manufacturers have built up capacity for the 10 nanometer node in 2016, and we also saw healthy demand from memory manufacturers both for DRAM and 3D NAND production. Together with solid growth in net service and field option sales, this has led to record 2016 net sales of EUR 6.8 billion. These trends are expected to continue into 2017, as evidenced by our first-quarter guidance.

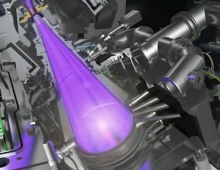

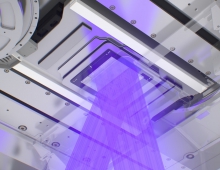

ASML is pushing chipmaker clients such as Intel, Samsung Electronics and Taiwan Semiconductor Manufacturing to upgrade to its newest machines, called extreme ultraviolet lithography systems or EUV, which can etch smaller circuits while increasing capacity and speed.

Last November, ASML agreed to buy about a quarter Carl Zeiss SMT for 1 billion euros as part of its EUV push. While ASML is speeding up development a new optical system for the next generation of machines, Nikon in mid-October announced it would slash development costs for immersion steppers, lithography machines that etch semiconductor circuits onto silicon, citing slow uptake by customers.

ASML's fourth-quarter sales rose 33 percent to 1.91 billion euros, marking the fourth consecutive year of revenue growth.

"Regarding EUV, we executed on the customer-aligned productivity and availability targets, which gave customers the confidence to place a significant number of orders, leading to an EUV backlog of about EUR 2 billion. These orders show that they are committed to take EUV into production, and we expect that the first customers will start volume manufacturing with EUV at the 7 nanometer logic node and the mid-10 nanometer DRAM node. We are now moving to the next phase of EUV industrialization. We remain committed to deliver the performance requirements for customer volume manufacturing, while continuing to build up our manufacturing, supply chain and service capabilities," Wennink said.