NAND Flash Industry To Grow More in 2015

The shrinking NAND Flash production costs resulting from the NAND Flash industry's improving technology are expected to boost demand for various end products, including SSDs and eMMCs, according to DRAMeXchange. The research firm estimates that NAND Flash industry value will rise consistently in 2015, reaching as high as US$ 27.6 billion on annual growth of 12%.

Based on the tendency for new hardware devices to be released in the third and fourth quarters of each year and the likelihood of demand being restrained in the first two quarters, Sean Yang, an assistant vice president of DRAMeXchange, believes the NAND Flash market will thrive mostly during the second half of 2015 rather than during the first half. Increased NAND Flash demand in both the third and fourth quarters is expected to benefit the NAND Flash industry tremendously by easing any potential oversupply that occurs in the two preceding quarters and allowing the market to reach a potential balance. By the end of 2015, the NAND Flash industry has a good chance of remaining healthy and growth is expected to continue.

2015 will be a critical period for NAND Flash manufacturers as they try to slow capacity expansion. Thus, 2015 wafer volumes are expected to only rise 8% on year. The keys for the supply side will be placed on the 15/16nm manufacturing processes intended for Planar NAND products, 3D NAND Flash technology, and TLC-based applications.

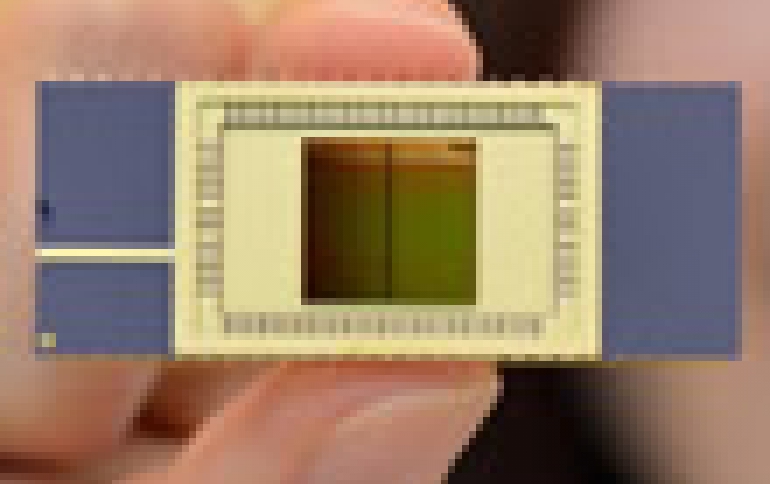

Numerous 1ynm eMMC/eMCP and SSD products have already found their way into first-tier smartphones and tablets during the third and fourth quarters of this year. Although Samsung and Toshiba both began to produce 15/16nm products in limited quantities from the end of the third quarter, neither plans to start mass production immediately, as the yield rates for the 15/16nm components tend to take longer to improve compared to those produced on the 1ynm manufacturing process. As a result of their yield rate being limited, components made on the 15/16nm processes will not be applied in any embedded products until after the second quarter of next year. In an attempt to counter the difficulties involved in manufacturing Planar NAND products, some manufacturers turned their attention towards developing 3D NAND Flash, which is one of the industry's other emerging technologies.

Samsung has produced 3D NAND Flash products geared towards Enterprise SSDs since the fourth quarter of last year, and is currently looking to release 3D NAND Flash products that will be applicable to Client-based SSDs. In a recent investor's meeting, Intel also discussed the 3D NAND Flash SSDs that it plans to release with Micron, and confirmed that the SSDs' trial production is already underway. The two companies' official 3D NAND Flash SSDs are currently slated for a release in the second half of 2015. Looking ahead to next year, Yang believes that the progresses made by the early 3D NAND Flash adopters will lead to a series of similar developments from manufacturers who have yet to announce their plans with the technology. Considering the time needed to improve a 3D NAND Flash product's cost and performance, their adoption will unlikely become significant until the fourth quarter of next year or the first quarter of 2016.

Owing to the respectable price-to-performance ratio of its TLC-embedded products, Samsung has become highly successful in the eMMC/eCMP Client SSD market, and has managed to encourage a growing number of NAND Flash manufacturers to promote similar products during the second half of 2014. As the focus in the industry is starting to shift from the high-end to mid-to-low end sectors, TLC will gradually become an ideal format for manufacturers looking to lower their products' Bill of Materials Cost (BOM-Cost). The fact that controller chips are able to resolve the speed and performance issues typically associated with TLC also make them an attractive option for PC and mobile vendors. As Apple will begin using TLC components and other first-tier vendors are likely to follow suit, the adoption of TLC will likely improve significantly next year. DRAMeXchange believes TLC's output ratio will rise to approximately 41% in 2015.

The NAND Flash industry's bit demand volume for 2015 is estimated to grow 42.8% on year to 38,379.9 million (2GB equiv). Approximately 85% of the industry's overall bit demand will be accounted for by smartphones, tablets, and SSDs. Due to the growing popularity of low to mid-tier handset models, shipments of smartphones are forecasted to rise by 12.4% on year by the end of 2015, said Yang. Tablets, on the other hand, will see slightly weaker shipments during the same period as their maturity increases and the specs among different brands become less distinguishable. In the near future, improving the storage capacity of NAND Flash components will be critical for tablet manufacturers looking to succeed in the market. Apple has already managed to pull itself ahead in the high memory storage race after equipping its new iPhones and iPads with NAND Flash components featuring storage capacities of 64GB or more. In addition to pressuring tablet vendors to raise the standards of their tablet devices, Apple's move has encouraged numerous manufacturers from the mid to low-tier sectors to increase the amount of storage offered in their smartphones. By the time 2015 ends, DRAMeXchange estimates that the average capacity of NAND Flash (eMMC) components used in smartphones will grow by approximately 18% compared to the same period last year.

SSDs are becoming an important driver of NAND Flash growth. The capacity of SSDs used in enterprise level notebooks will increase gradually due to the emphasis these notebooks place on storage stability and efficiency. The penetration rate of the SSDs used in high-end consumer devices, likewise, is expected to rise as more and more vendors follow the Macbook Pro and Macbook Air's example of using SSDs. Looking ahead to 2015, DRAMeXchange projects that the adoption of SSDs among notebook PCs will increase to approximately 26%. The usage rate of Enterprise SSDs, meanwhile, will remain strong on the back of the industry's rising cloud computing demands, the needs of business smartphone users to retrieve and save data efficiently, and the growing demands for higher storage capacities from data centers and server businesses. Taking the growth of Client SSDs and Enterprise SSDs into account, TrendForce forecasts the demand for SSDs will be higher than those of any other NAND Flash products produced during 2015.