Samsung to Focus On Foundry Biz as Memory Chip Demand Slackens

Samsung plans to focus on nurturing the non-memory chip and foundry business as part of its new growth engine, as memory-chip inventories remain high.

Lee Jae-yong, vice chairman of Samsung Electronics Co., said Wednesday that the tech giant will focus on nurturing the non-memory chip and foundry business as part of its new growth engine.

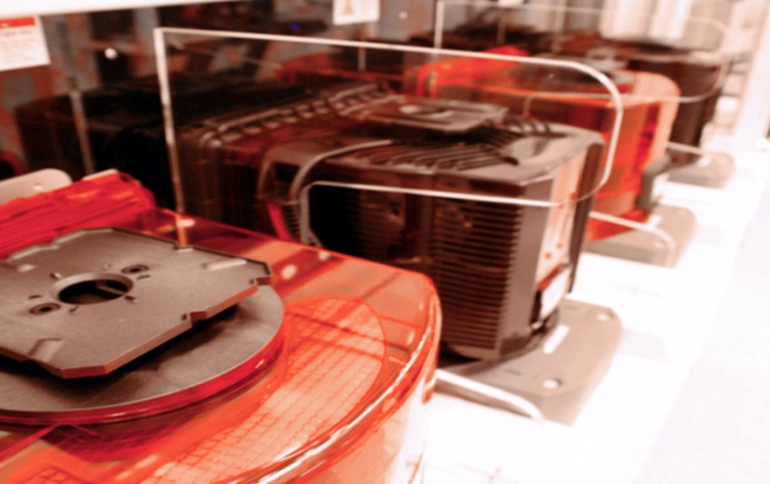

Lee made the remark during his meeting with Hong Young-pyo, floor leader of the ruling Democratic Party (DP), and lawmakers at the company's production line in Hwaseong, some 60 kilometers south of Seoul.

"There have been always crises, but we will overcome them through consistent innovation," said Lee Jae-yong, vice chairman of Samsung Electronics, during his meeting with Hong Young-pyo, floor leader of the ruling Democratic Party (DP), and lawmakers at the company's production line in Hwaseong.

"Samsung will create many decent jobs as creating employment opportunities is also our responsibility. The company will make more effort to cooperate with smaller firms," he added.

The company has traditionally invested heavily in memory semiconductors, such as dynamic random-access memory (DRAM) and NAND flash chips. Lee's remarks are seen as reflecting Samsung's potential strategy in fostering the non-memory chip business, a sector where Korean chipmakers stand on relatively weak footing against their U.S., European and Chinese rivals.

Samsung is set to report its first drop in quarterly profit in two years, and investors are counting on the world’s biggest chipmaker to cut capital spending to keep profits flowing during a supply glut.

The company already cut annual capital expenditure last year. Chips make up the biggest portion of income for the Suwon, South Korea-based company, which is struggling with falling sales of Galaxy smartphones and iPhone screens.

Rival SK Hynix Inc. made it clear that spending cuts are coming this year when reporting results last week.

Memory-chip inventories remain high as customers such as data centers hold off on expansion plans amid the brewing U.S.-China trade war, as well as slower global economic growth. The price of dynamic random-access memory used in servers is projected to fall by more than 20 percent quarter-on-quarter in the first three months of this year, according to TrendForce.