Relationships Among Panel Suppliers and Brands and Their Impact on TV Industry Dynamics

The ongoing changing alliances and joint ventures among Asian TFT LCD panel makers is creating new opportunities for the flat panel display and TV industries.

As the availability of the HD content increases, the demand for new TV panels is also booming, positioning the LCD TVs as the hottest products in the market of consumer electronics. With the demand for cheaper panels to rise, Japanese, S.Korean and Taiwanese panel makers establish alliances and joint ventures in order to be competitive.

DisplaySearch recently released a new topical report called Asian LCD TV Panel Maker Alliances and Joint Ventures Analysis that summsarizes these issues.

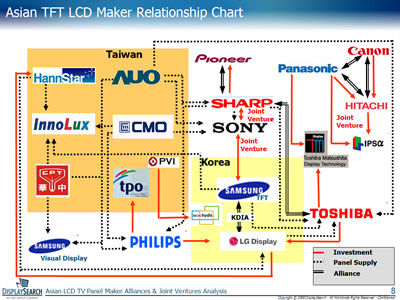

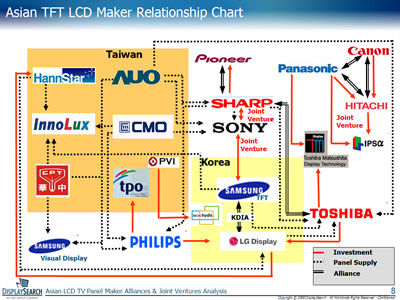

In the last year, many new relationships have been formed including alliances, mutual investments and supplier agreements, as shown in the figure below. These new relationships are impacting fab expansion plans and timing, supplier-assembler-brand relationships, panel allocation by market segment and brand, regional supply strategies and more.

DisplaySearch's report covers the most critical strategic analysis behind the multiple relationships among the Asian LCD TV panel suppliers, TV brands and OEMs. The LCD TV panel supply and allocation relationships in 2007 and 2008 expectations are revealed in the report as well as the LCD TV brands? 2008 and 2009 business plan and strategies.

Key findings in the report include:

Samsung and Sony have aggressive strategies to each capture 20% share of worldwide LCD TV market, driving them to purchase more LCD TV panels from others panel makers and OEM TV makers, especially from Taiwan suppliers. Samsung and Sony had entered an LCD manufacturing joint venture in 2005 (S-LCD).

Among the top five brands, Sharp has the lowest Y/Y growth rate and has allocated more of its fabrication of LCD panels to external customers. The most significant is Sony.

The most impacted TFT LCD panel makers by the Sony-Sharp joint venture will be Samsung, AUO (AU Optronics, Taiwan) and CMO (Chi Mei Optoelectronics, Taiwan). These three will have to re-assess their customer base when considering an investment in Gen 10 fabrication facilities. Sony and Sharp, the world's second- and third-largest liquid crystal display TV makers, announced last month they would set up a joint venture to make and sell large LCD panels and modules.

DisplaySearch also estimates that the Sharp Gen 10 glass substrate size will be 2880 x 3130 mm, which will provide better economic cuts of 40" and 46" panels for Sony than previous candidate sizes. 2880 x 3130 mm is also optimum for 57" and 65" panels produced 8-up and 6-up, respectively. The new 10G plant is expected to produce 72,000 substrates per month, according to Sharp. The Japanese company invested in late 2007 approximately 380 billion yen (including land acquisition costs) for the new 1.27 million m2 site area.

Through the S-LCD joint venture of Sony and Samsung and their focus on the 40" and larger TV market, the two companies have successfully grown the 40" and larger LCD TV market, extended their brand recognition and market share and applied significant pressure on other TV brands.

DisplaySearch estimates that the recently announced IPS Alpha Gen 8 fab will focus on 32" and 46" panels, as well as 52" LCD TV panels for Panasonic. IPS Alpha Technology, Ltd is a joint venture among Hitachi, Toshiba, Matsushita Electric, and Hitachi Displays, Ltd., formed in 2005.

Through the KDIA (Korea Display Industry Alliance), Samsung and LG Display (formerly known as LG.Philips LCD) will develop a complicated and delicate relationship covering their product plans, components and new fabs. The two top leaders in Korean IT industry and two bitter rivals in the global display battlefield, Samsung and LG, joined forces to challenge the market last May.

Through the alliance of Pioneer and Sharp, as well as Pioneer's announcement to retreat from plasma panel manufacturing, Pioneer will begin LCD TV manufacturing with assistance from Sharp. This was also officially confirmed by Pioneer and the first LCD TVs under Pioneer's KURO series will be available in Q4.

JVC will supply LCD TVs made at their Mexico plant to Funai, while JVC will market LCD TVs in Europe produced by Funai?s Poland plant. Meanwhile, the two will possibly co-develop LCD TVs in the future.

DisplaySearch expects more joint ventures and alliances in the future, especially among smaller LCD TV panel makers seeking investments in expensive Gen 7 and Gen 8 fabs.

For more information about the report, contact DisplaySearch.

DisplaySearch recently released a new topical report called Asian LCD TV Panel Maker Alliances and Joint Ventures Analysis that summsarizes these issues.

In the last year, many new relationships have been formed including alliances, mutual investments and supplier agreements, as shown in the figure below. These new relationships are impacting fab expansion plans and timing, supplier-assembler-brand relationships, panel allocation by market segment and brand, regional supply strategies and more.

DisplaySearch's report covers the most critical strategic analysis behind the multiple relationships among the Asian LCD TV panel suppliers, TV brands and OEMs. The LCD TV panel supply and allocation relationships in 2007 and 2008 expectations are revealed in the report as well as the LCD TV brands? 2008 and 2009 business plan and strategies.

Key findings in the report include:

Samsung and Sony have aggressive strategies to each capture 20% share of worldwide LCD TV market, driving them to purchase more LCD TV panels from others panel makers and OEM TV makers, especially from Taiwan suppliers. Samsung and Sony had entered an LCD manufacturing joint venture in 2005 (S-LCD).

Among the top five brands, Sharp has the lowest Y/Y growth rate and has allocated more of its fabrication of LCD panels to external customers. The most significant is Sony.

The most impacted TFT LCD panel makers by the Sony-Sharp joint venture will be Samsung, AUO (AU Optronics, Taiwan) and CMO (Chi Mei Optoelectronics, Taiwan). These three will have to re-assess their customer base when considering an investment in Gen 10 fabrication facilities. Sony and Sharp, the world's second- and third-largest liquid crystal display TV makers, announced last month they would set up a joint venture to make and sell large LCD panels and modules.

DisplaySearch also estimates that the Sharp Gen 10 glass substrate size will be 2880 x 3130 mm, which will provide better economic cuts of 40" and 46" panels for Sony than previous candidate sizes. 2880 x 3130 mm is also optimum for 57" and 65" panels produced 8-up and 6-up, respectively. The new 10G plant is expected to produce 72,000 substrates per month, according to Sharp. The Japanese company invested in late 2007 approximately 380 billion yen (including land acquisition costs) for the new 1.27 million m2 site area.

Through the S-LCD joint venture of Sony and Samsung and their focus on the 40" and larger TV market, the two companies have successfully grown the 40" and larger LCD TV market, extended their brand recognition and market share and applied significant pressure on other TV brands.

DisplaySearch estimates that the recently announced IPS Alpha Gen 8 fab will focus on 32" and 46" panels, as well as 52" LCD TV panels for Panasonic. IPS Alpha Technology, Ltd is a joint venture among Hitachi, Toshiba, Matsushita Electric, and Hitachi Displays, Ltd., formed in 2005.

Through the KDIA (Korea Display Industry Alliance), Samsung and LG Display (formerly known as LG.Philips LCD) will develop a complicated and delicate relationship covering their product plans, components and new fabs. The two top leaders in Korean IT industry and two bitter rivals in the global display battlefield, Samsung and LG, joined forces to challenge the market last May.

Through the alliance of Pioneer and Sharp, as well as Pioneer's announcement to retreat from plasma panel manufacturing, Pioneer will begin LCD TV manufacturing with assistance from Sharp. This was also officially confirmed by Pioneer and the first LCD TVs under Pioneer's KURO series will be available in Q4.

JVC will supply LCD TVs made at their Mexico plant to Funai, while JVC will market LCD TVs in Europe produced by Funai?s Poland plant. Meanwhile, the two will possibly co-develop LCD TVs in the future.

DisplaySearch expects more joint ventures and alliances in the future, especially among smaller LCD TV panel makers seeking investments in expensive Gen 7 and Gen 8 fabs.

For more information about the report, contact DisplaySearch.