Samsung to Slow Expansion of Chip Facilities in 2019

Samsung Electronics, the world’s No. 1 memory chip provider, is among the chipmakers that will likely cut back spending on memory chip production next year in in order to prevent rapid falls in memory prices.

At a biannual meeting on Samsung’s global business strategies held last week, the device solutions division’s main agenda was how to cope with the expected oversupply of memory chips next year, as demand is widely forecast to go downhill, with the market facing a stall in the “super cycle” driven by an emerging data economy.

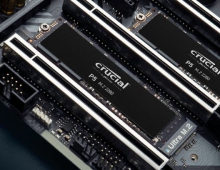

“Adjusting the pace of increasing production capacities for DRAM and NAND flash chips was discussed at the meeting presided over by Vice Chairman Kim Ki-nam and heads of the chipmaker’s overseas branches,” an industry source told The Korea Herald.

According to news varioud reports, Samsung is planning to curtail its production of memory chips next year to bit growth of less than 20 percent for DRAM and 30 percent for NAND.

The company said during a conference call on its third-quarter earnings in November that its annual bit growth for DRAM is estimated to be around 20 percent and 40 percent for NAND.

Bit growth refers to the increased supply of memory chips in bit volume that helps estimate capacities of each chip provider.

With the lowered bit growth estimates, Samsung is expected to conservatively execute its investment plans for memory production.

Its 30 trillion-won investment plan for construction of a second fabrication line for DRAM at its newest Pyeongtaek campus in Gyeonggi Province could be carried out more carefully than initially planned, as part of Samsung’s strategy to prevent falls in DRAM prices by limiting new growth in supply.

The second Pyeongtaek plant is scheduled to be completed by the end of the first half of next year.

Samsung is also expected to limit increasing its DRAM production on the second floor of the first fabrication line in Pyeongtaek, amid the oversupply outlook.

The Korean chipmaker’s slashed forecasts for fourth-quarter earnings add woes to the negative outlook for 2019.

Micron Technology’s first-quarter earnings announcement for the fiscal year of 2019 that ended on Nov. 31 fueled worries about the upcoming downturn in the chip market.

Samusng was not avaiable for a comment.