The State of Music Mid-Way Through 2017

In the first half of 2017, growth in revenues from music subscription streaming services in the U.S. continued to offset declines in traditional unit based sales, according to a report released by the Recording Industry Association of America (RIAA).

The estimated retail revenues from recorded music in the United States grew 17% in the first half of 2017 to $4.0 billion, powered by 30 million music subscriptions, artists and the professionals who support them.

At wholesale value, the industry was up 14.6% to $2.7 billion. This growth reflects a continuation of the trends from 2016, but overall market revenues are still significantly below the levels they were in 1999.

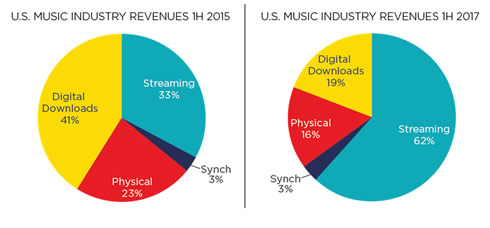

Record labels continue embrace new business models, partnering with more than 400 services worldwide. The pace of change embraced by record labels is staggering. Just two years ago, digital downloads was the largest format, and streaming was only beginning to take hold. Fast forward a few short years, and the business is already dramatically different.

More than any other creative industry, music is a digital business, with approximately 80% of revenues coming from a wide array of digital services.

RIAA estimates that there may be a TRILLION streams in 2017, counting both on-demand services and digital radio (some 460 billion in first half of the year).

Revenues from streaming music services accounted for 62% of the total market for the first half of 2017. Total revenues from streaming platforms were up 48% to $2.5 billion. The streaming category includes revenues from subscription services (such as paid versions of Spotify, TIDAL, and Apple Music, among others ), digital and customized radio services including those revenues distributed by SoundExchange (like Pandora, SiriusXM, and other Internet radio), and ad-supported on-demand streaming services (such as YouTube, Vevo, and ad-supported Spotify).

As you can see from the chart below, the amount of revenues that the three major categories of streaming generated is dramatically different, as is their disparate contribution to overall revenues.

RIAA also notes that an astonishing 58 hours of watching music videos would take to generate a single dollar for music creators.

The total value of shipments of physical products decreased just 1% to $632 million, a much lower rate of decrease than recent historical trends. The rate of returns of physical goods to record labels decreased in the first half of the year, helping bolster the revenue figures. Revenues from shipments of CDs were down 3% to $431 million, while vinyl albums were up 3% to $182 million. Vinyl albums comprised 29% of total physical shipments at retail value - their highest share since the mid 1980's.