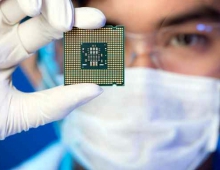

TSMC Sees Strong Demand For Its 28nm Technology

TSMC will invest some additional $9 billion this year as it sees a strong demand for its 28nm chip making technology and is also getting ready for migratign to the 20nm process.

During an investor meeting in Taipei, TSMC's chairman and CEO Morris Chang said his company's 28nm chip shipment this year will triple that of last year, which should boost its annual increase in revenue to above the industry's average rate of seven percent.

According to a China Times report, TSMC's 28nm silicon orders are fueled by strong demand for ARM processors, baseband chips, graphics processors and x86 processors.

Qualcomm, Huawei, NVIDIA, AMD and possibly Apple (A6X and A7) processors will be ordering more 28nm-based chipsets from the foundry throughout the year.

Chang added that is company's already seen enough clients and demand for the upcoming 20nm manufacturing process, which should have a more significant financial contribution in 2014. The exec also predicted that at TSMC, its 20nm production will see a bigger growth rate between 2014 and 2015 than its 28nm counterpart did between 2012 and 2013.

Higher than expected demand for TSMC's products in the fourth quarter of 2012 resulted in above-guidance revenue and profit margins for the Taiwanese foundry.

According to a China Times report, TSMC's 28nm silicon orders are fueled by strong demand for ARM processors, baseband chips, graphics processors and x86 processors.

Qualcomm, Huawei, NVIDIA, AMD and possibly Apple (A6X and A7) processors will be ordering more 28nm-based chipsets from the foundry throughout the year.

Chang added that is company's already seen enough clients and demand for the upcoming 20nm manufacturing process, which should have a more significant financial contribution in 2014. The exec also predicted that at TSMC, its 20nm production will see a bigger growth rate between 2014 and 2015 than its 28nm counterpart did between 2012 and 2013.

Higher than expected demand for TSMC's products in the fourth quarter of 2012 resulted in above-guidance revenue and profit margins for the Taiwanese foundry.