NAND Flash Industry Structure to Transform as OCZ Declares Bankruptcy

With Toshiba ready to take over OCZ Technology's SSD business, more and more changes are expected to emerge in the SSD industry.

Affected by intensified competition and increased financial pressures, US-based SSD company, OCZ Technology declared bankruptcy on 11/27 and announced its plans to sell assets to the Japanese NAND Flash manufacturer, Toshiba. The acquisition proposal has officially been approved by US courts, and for now, OCZ?s operations remain unchanged.

According to DRAMeXchange, the unstable shipments and pricing fluctuations of NAND Flash products have made operational pressures increasingly more difficult to handle for independent SSD makers. Looking at the area of product mix, most independent SSD manufacturers tend to place a high amount of emphasis on MLC-based products. Samsung, by comparison, has recently begun to promote its TLC-based SSDs (based on its self-developed controller chips), and is managing to derive respectable profits from both the retail and PC OEM markets thanks to its products' price advantage and price performance ratio. The Korean company's success can be said to have generated considerable pressure for manufacturers that are trying to seize the market through low pricing strategies.

Due in part to the eliminations resulting from the intensified competition in the past 10 years, the NAND Flash market is currently left with only four major manufacturers. Observing the production side, Samsung accounts for nearly 37% of the entire NAND Flash industry's output, whereas the proportion accounted for by Toshiba is approximately 36%. Both Micron and Intel own a combined 16% of the markets' output shares, and SK Hynix, which is in fourth place, has 11%. Following the NAND Flash market's shift of focus from UFDs and memory cards to OEM-SSD, eMMC, and eMCP products, the supplies of the retail market vendors have gradually begun to decline. The pricing bargain has turned negative toward SSD manufacturer.

As NAND Flash chips are used in more than 80% of the SSDs, the shipment and pricing uncertainties within the market have increased the financial pressures for independent SSD manufacturers, and are raising the challenges associated with product planning and pricing. In the coming periods, it appears likely that the SSD market will eventually be taken over by the industry's more dominant brands. In addition to the originally brands and the companies that have established strong relationships with major NAND Flash manufacturers (for instance, Kingston, Crucial etc), the industry also seems to be dominated by NAND Flash manufacturers like Samsung that has directly jumped into the market to establish operations and to attract consumer attention through brand image and pricing.

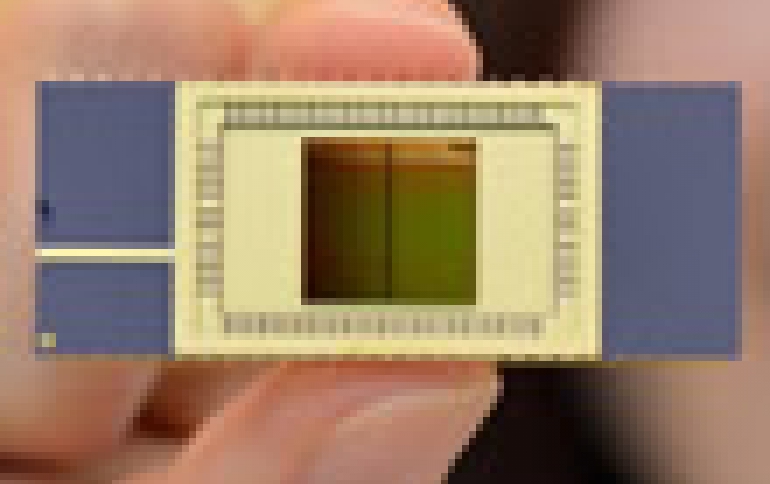

As noted by TrendForce, the fact that major NAND Flash manufacturers are investing more and more resources in SSD development has made matters worse for independent SSD manufacturers. With NAND Flash components gradually becoming a critical part of storage systems and the interest in cloud computing expanding, the enterprise-level NAND Flash makers have sought to strengthen the effectiveness of their SSD product lines through either self-development or relevant acquisitions. In addition to ensuring sufficient supplies and stable price, one of the major determinants of a manufacturer's competitiveness lies in its overall grasp of controller chip technology. The fact that the effectiveness of the SSD controller chip determines the overall strength of the final SSD product has encouraged companies like LSI to acquire SandForce in 2011 and manufacturers such as SK Hynix to seek out LAMD (Link-A-Media-Device). This year, traditional hard drive vendors like Seagate and Western Digital have also made notable efforts to perform their own acquisitions. For instance, EMC has acquired Scale I/O, Western Digital bought Velobit, Virident and STEC, SandiSK acquired Smart Storage and just last month, Cisco bought Whiptail.

The manufacturers with direct control over their own NAND Flash production - for example, Samsung, Toshiba, SanDisk, SK Hynix, Micron and Intel - are continuing to strengthen the integration between the upper and lower streams of their SSD supply chains. HDD manufacturers such as Seagate, WD, and Hitachi, on the other hand, are venturing from the storage system markets into SSD territory as a means to seize further opportunities. Starting next year, competition within the entire SSD industry is expected to become a lot more intense.

According to DRAMeXchange, the unstable shipments and pricing fluctuations of NAND Flash products have made operational pressures increasingly more difficult to handle for independent SSD makers. Looking at the area of product mix, most independent SSD manufacturers tend to place a high amount of emphasis on MLC-based products. Samsung, by comparison, has recently begun to promote its TLC-based SSDs (based on its self-developed controller chips), and is managing to derive respectable profits from both the retail and PC OEM markets thanks to its products' price advantage and price performance ratio. The Korean company's success can be said to have generated considerable pressure for manufacturers that are trying to seize the market through low pricing strategies.

Due in part to the eliminations resulting from the intensified competition in the past 10 years, the NAND Flash market is currently left with only four major manufacturers. Observing the production side, Samsung accounts for nearly 37% of the entire NAND Flash industry's output, whereas the proportion accounted for by Toshiba is approximately 36%. Both Micron and Intel own a combined 16% of the markets' output shares, and SK Hynix, which is in fourth place, has 11%. Following the NAND Flash market's shift of focus from UFDs and memory cards to OEM-SSD, eMMC, and eMCP products, the supplies of the retail market vendors have gradually begun to decline. The pricing bargain has turned negative toward SSD manufacturer.

As NAND Flash chips are used in more than 80% of the SSDs, the shipment and pricing uncertainties within the market have increased the financial pressures for independent SSD manufacturers, and are raising the challenges associated with product planning and pricing. In the coming periods, it appears likely that the SSD market will eventually be taken over by the industry's more dominant brands. In addition to the originally brands and the companies that have established strong relationships with major NAND Flash manufacturers (for instance, Kingston, Crucial etc), the industry also seems to be dominated by NAND Flash manufacturers like Samsung that has directly jumped into the market to establish operations and to attract consumer attention through brand image and pricing.

As noted by TrendForce, the fact that major NAND Flash manufacturers are investing more and more resources in SSD development has made matters worse for independent SSD manufacturers. With NAND Flash components gradually becoming a critical part of storage systems and the interest in cloud computing expanding, the enterprise-level NAND Flash makers have sought to strengthen the effectiveness of their SSD product lines through either self-development or relevant acquisitions. In addition to ensuring sufficient supplies and stable price, one of the major determinants of a manufacturer's competitiveness lies in its overall grasp of controller chip technology. The fact that the effectiveness of the SSD controller chip determines the overall strength of the final SSD product has encouraged companies like LSI to acquire SandForce in 2011 and manufacturers such as SK Hynix to seek out LAMD (Link-A-Media-Device). This year, traditional hard drive vendors like Seagate and Western Digital have also made notable efforts to perform their own acquisitions. For instance, EMC has acquired Scale I/O, Western Digital bought Velobit, Virident and STEC, SandiSK acquired Smart Storage and just last month, Cisco bought Whiptail.

The manufacturers with direct control over their own NAND Flash production - for example, Samsung, Toshiba, SanDisk, SK Hynix, Micron and Intel - are continuing to strengthen the integration between the upper and lower streams of their SSD supply chains. HDD manufacturers such as Seagate, WD, and Hitachi, on the other hand, are venturing from the storage system markets into SSD territory as a means to seize further opportunities. Starting next year, competition within the entire SSD industry is expected to become a lot more intense.