3D-NAND Flash Development To Accelerate Next Year

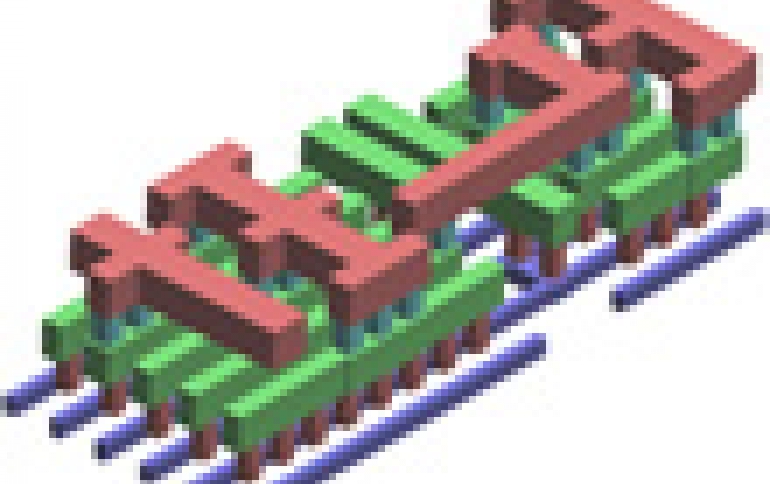

NAND Flash suppliers will start accelerating their development of 3D-NAND Flash soon as a means to overcome the memory scaling limit.

The growth of Smartphones, tablets, and SSDs helped boost NAND Flash demand to 46% in 2013, according to DRAMeXchange. With SSD applications gradually being sought after by the enterprise clients, demand for NAND Flash is expected to reach 36% in 2014, while industry value is set to exceed US$ 27 Billion.

An increasing number of NAND Flash suppliers appear to be making a gradual move towards 1xnm technology since 3Q13. With more and more 20nm-class SSDs, eMMCs, and eMCPs finding their way into mobile devices, the shipment proportion of 20nm and 1xnm products have risen past 90%, effectively making them the mainstream NAND Flash manufacturing technologies within the industry. Given the major obstacles associated with going below 1xnm, various NAND Flash suppliers have begun to accelerate their development of 3D-NAND Flash as a means to overcome the memory scaling limit.

Last August, Samsung started promoting promote 3D-NAND Flash-based server SSDs. The company has managed to shorten the time taken to integrate its controller and NAND Flash chips following the development of its "V-NAND" technology in 2H13. The technology has effectively allowed the company to create high density memory products that take full advantage of 3D NAND Flash?s benefits. Through the production of its 24-layer 128 Gb V-NAND chips, Samsung will be looking to make a major entrance in the server SSD market, and has already begun delivering samples to server vendors and data centers during 4Q13. The Korean company is currently ahead of all of its major competitors in terms of 3D NAND Flash applications; Its "V-NAND" facilities will be based primarily in its existing Korean plant as well as the newly established factory in Xi'an, China.

Using their own 3D-NAND Flash technology, known as "BiCS," Toshiba and SanDisk will also be looking to exert major impact within the industry. The two manufacturers' 3D NAND Flash products have already undergone various production tests since 2Q13, and are anticipated to be manufactured using 1Y and 1Z nm technology in 2015. In an attempt to facilitate the mass production of its 3D NAND Flash products, the Fab 5 "second phase" construction initiated by Toshiba at its Yokkaichi plant will likely be completed during the third quarter of this year. The products? standard production, meanwhile, is expected to start as early as 4Q14.

Looking at SK Hynix, Micron, and Intel, each are expected to migrate to 16nm technology as they begin transitioning towards 3D NAND Flash products. The companies' test samples are anticipated to be delivered to clients during 2Q14, while the mass production stages are expected to take place in 4Q14.

Regarding 2014 as a whole, TrendForce projects 3D-NAND Flash will only account for an estimated 3% of the NAND Flash industry's overall supply, given that most of the manufacturers would still be stuck in the testing and sample delivery phase. However, the overall development of 3D NAND Flash is happening a lot faster than expected, and with mass production likely to take place next year, 3D-NAND Flash market share is likely to rise up to as much as 20% in 2015.

The NAND Flash unit cost is also expected to lower rapidly and become cheaper per storage unit as 3D NAND Flash technology matures.

An increasing number of NAND Flash suppliers appear to be making a gradual move towards 1xnm technology since 3Q13. With more and more 20nm-class SSDs, eMMCs, and eMCPs finding their way into mobile devices, the shipment proportion of 20nm and 1xnm products have risen past 90%, effectively making them the mainstream NAND Flash manufacturing technologies within the industry. Given the major obstacles associated with going below 1xnm, various NAND Flash suppliers have begun to accelerate their development of 3D-NAND Flash as a means to overcome the memory scaling limit.

Last August, Samsung started promoting promote 3D-NAND Flash-based server SSDs. The company has managed to shorten the time taken to integrate its controller and NAND Flash chips following the development of its "V-NAND" technology in 2H13. The technology has effectively allowed the company to create high density memory products that take full advantage of 3D NAND Flash?s benefits. Through the production of its 24-layer 128 Gb V-NAND chips, Samsung will be looking to make a major entrance in the server SSD market, and has already begun delivering samples to server vendors and data centers during 4Q13. The Korean company is currently ahead of all of its major competitors in terms of 3D NAND Flash applications; Its "V-NAND" facilities will be based primarily in its existing Korean plant as well as the newly established factory in Xi'an, China.

Using their own 3D-NAND Flash technology, known as "BiCS," Toshiba and SanDisk will also be looking to exert major impact within the industry. The two manufacturers' 3D NAND Flash products have already undergone various production tests since 2Q13, and are anticipated to be manufactured using 1Y and 1Z nm technology in 2015. In an attempt to facilitate the mass production of its 3D NAND Flash products, the Fab 5 "second phase" construction initiated by Toshiba at its Yokkaichi plant will likely be completed during the third quarter of this year. The products? standard production, meanwhile, is expected to start as early as 4Q14.

Looking at SK Hynix, Micron, and Intel, each are expected to migrate to 16nm technology as they begin transitioning towards 3D NAND Flash products. The companies' test samples are anticipated to be delivered to clients during 2Q14, while the mass production stages are expected to take place in 4Q14.

Regarding 2014 as a whole, TrendForce projects 3D-NAND Flash will only account for an estimated 3% of the NAND Flash industry's overall supply, given that most of the manufacturers would still be stuck in the testing and sample delivery phase. However, the overall development of 3D NAND Flash is happening a lot faster than expected, and with mass production likely to take place next year, 3D-NAND Flash market share is likely to rise up to as much as 20% in 2015.

The NAND Flash unit cost is also expected to lower rapidly and become cheaper per storage unit as 3D NAND Flash technology matures.