Chip Makers' Revenue to Drop This Quarter

The development momentum of advanced chip production processes has been dropping due to weakening demand in most end markets, including smartphones.

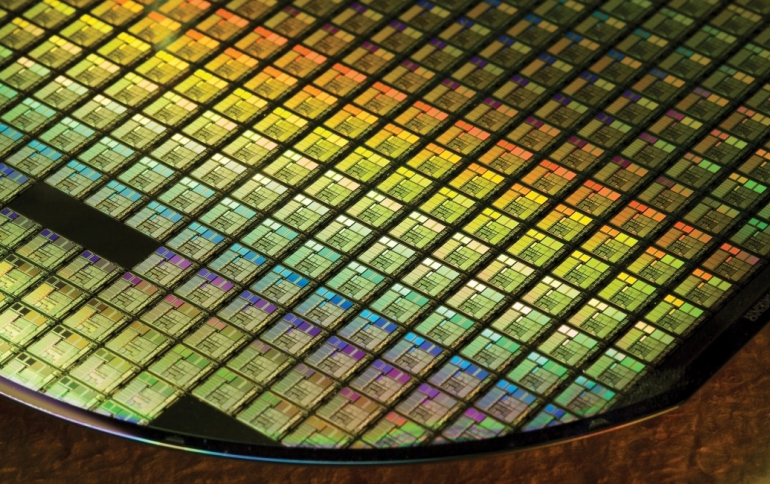

According to TrendForce, foundries face a severe challenge in 1Q19, and global foundry production revenue for the first quarter is expected to decline by around 16% compared to the same quarter 2018, arriving at 14.6 billion USD. TSMC, Samsung and GlobalFoundries take first, second and third place respectively in market shares, and although TSMC's market share reaches 48.1% , it suffers a near 18% decline in YoY growth.

TrendForce says that the 1Q19 rankings for foundries remains almost the same as last year's save for Powerchip, who might be surpassed by TowerJazz due to falling demand in the 12-inch foundry market . However, upon closer examination of the top ten foundries (including TSMC, Samsung LSI, GlobalFoundries, UMC, SMIC, Powerchip etc.), they all exhibited double-digit downslides in revenue performance compared to the same quarter last year. This is also due to the weakening demand in the 12-inch foundry market.

In contrast, though companies who have 8-inch foundries as their main focus, such as TowerJazz, Vanguard, Hua Hong, Dongbu HiTek etc., did not show an outstanding YoY revenue performance comparable to the same period last year due to the gradual alleviation of the shortage situation, these 8-inch focused foundries still managed to hold their ground in a relatively gloomy semiconductor market of the first season compared to the double digit decline suffered by their 12-inch counterparts.

Although market share champion TSMC scrapped wafers due to the defective photoresist chemical incident in the first quarter, and was affected by the lower-than-expected sales performance among its major smartphone customer base and the subsided cryptocurrency gold rush, it still sits snugly atop the throne in foundry market shares. Looking forward, TrendForce expects TSMC's 2019 market performance to be aided not only by the first quarter shipment orders pushed to the second, but also by contributions to revenue from collaboration with customers such as HiSilicon, Qualcomm, Apple and AMD etc.

Samsung Foundry, which split off back in 1H17, landed second place in market shares thanks to contributions from its System LSI division. Yet according to estimations, their revenue from external customers contribute to only about 40% of its revenue. Samsung has also been promoting multi-project wafer (MPW) services in recent years. Apart from the active acquisition of advanced manufacturing services, their 8-inch production line located in Giheung, Korea will gradually contribute to Samsung Foundry's revenue as well. Samsung aims to secure a 25 % market share by 2023.

The global foundry production capacity will near the 70 billion USD threshold in 2019 looking forward. However various nuisances have impacted the 1Q19 market: Apart from the traditional offseason, weakening demand for consumer products, rather high inventory levels, falling demand in the car market, the Intel CPU shortage and the slowing of China's economic growth, the US-China trade dispute also presents major uncertainties for the global market.