China's Smartphone Market Dropped 7.5 percent in 2019, Outlook for 2020 Remains Challenging Due to Coronavirus

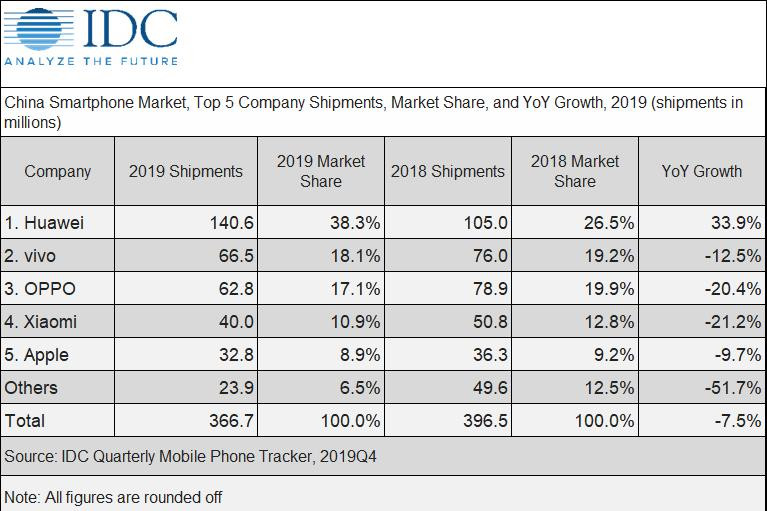

Smartphone shippments declined by 7.5% from a year ago in 2019, as a result of market saturation as well as a challenging economy.

According to IDC, in 4Q19, 86.2 million units shipped, down 15.6% year-on-year due to both Huawei’s large inventories as well as consumers waiting for cheaper 5G smartphones. This was the market’s 11th consecutive quarterly decline and its 3rd consecutive annual decline.

“In 2019, vivo was able to surpass OPPO for the number two spot, as the latter struggled to refine the positioning of its Reno series, while the former did well with its new mid-range iQOO and S series as well as 5G models,” says Will Wong, Research Manager for Client Devices at IDC Asia/Pacific. Wong adds, “In 4Q19, both Huawei and Apple gained share over the same period one year ago as a result of their strong branding. Nevertheless, the Wuhan coronavirus could have a Black Swan effect on the market in the first half of 2020."

2019Q4 Top 5 Smartphone Vendor Highlights:

- Huawei’s flagship Mate 30 series and 5G products helped sustain its strong performance, though sell-out has been limited by the high prices of its 5G handsets. The vendor’s strong brand appeal and channel management continued to be the growth driver, but the heavy inventories will remain a challenge to the vendor.

- vivo continued to target the mid-range segment by positioning its iQOO and S series in different channels. iQOO series mainly targeted tech-savvy users in the online channel, while the S series focused on the offline channel after the mid-range X series was repositioned as a high-end product.

- OPPO’s A series continued to be the vendor’s main driver in 2019Q4. Although OPPO launched 8 models for the Reno series in 2019 to target both mid-range and high-end segments, more marketing initiatives will still be needed to improve product positioning and awareness.

- Apple climbed to the fourth position in 2019Q4. Its competitive pricing strategy continued to help it compete with Huawei, while the increased focus on the eTailer channel also enhanced the vendor’s performance during the Singles’ Day shopping festival.

- Xiaomi continued to face challenges in strengthening its partnerships with offline channel players. The vendor’s performance has been largely supported by its low-end Redmi series, but this has also urged Xiaomi to target different consumer segments, such as young females, for its Mi and CC series to avoid direct competition.

The coronavirus outbreak impacted the Lunar New Year’s shopping season in late January and is also expected to have adverse effects in the following months. IDC expects China’s smartphone shipments to drop more than 30% year-on-year in 2020Q1, not to mention create uncertainty in product launch plans, the supply chain, and distribution channels, in the mid and long term.