Google's Ad Revenue Growth Shown to Slow

Google's Ad Revenue Growth Shown to Slow

Alphabet Inc. reported lower that expected first-quarter revenue and sparked fears that advertisers are shifting some spending to digital rivals.

The company's sales came in at $29.5 billion, excluding payments to distribution partners, Alphabet said in a statement on Monday.

Revenue from Google advertising rose 15 percent, the slowest pace since 2015. That was a contrast to scandal-plagued Facebook, which last week reported a 26 percent jump in ad sales.

Google is struggling to find the right mix of ad formats to use on mobile devices, voice assistant-enabled home speakers and in emerging markets.

Chief Financial Officer Ruth Porat attributed the slowdown to currency fluctuations and the timing of product changes.

Google’s search engine remains the first place consumers go when looking for products, letting the internet giant charge premium prices to retailers and other advertisers looking to reach customers online. But people have been increasingly going straight to Amazon.com Inc. to hunt for products and the e-commerce giant has been grabbing a larger share of the digital ad market, chipping away at Google’s lead.

The number of clicks on Google ads rose just 39 percent, the lowest year-over-year growth since 2016. The price, or cost per click, fell 19 percent.

Porat blamed that on YouTube, where clicks on ads didn’t grow as quickly in the first quarter, especially compared to a strong showing during the same period last year. The slowdown was caused by changes YouTube made last year to improve the experience for users and advertisers, she said on the conference call.

Operating margin was 23 percent, excluding the antitrust fine. Google capital expenditures dropped sharply in the quarter, in part because of a jump in real-estate spending in the year-earlier period.

But Google is still spending heavily to moderate videos on YouTube and to build an enterprise sales team for its cloud business.

Google’s other revenue, which includes the cloud business, rose 25 percent to $5.45 billion.

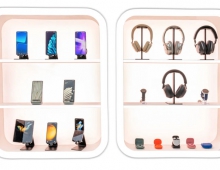

In the first quarter, sales of Google’s Pixel phones also struggled from intense competition in the premium smartphone market, Porat said. The company is expected to introduce lower-priced Pixel devices next month.

Alphabet has yet to tout significant revenue from its spending on ventures such as self-driving cars and its AI helper Google Assistant.

The latest results were dented by a $1.7 billion European Commission fine for antitrust violations.