Samsung's Smartphone Sales Increased in Europe

Samsung Electronics's smartphone shipments to Europe jumped in the second quarter from a year earlier, takig advantage of Huawei's struggle with a US trade ban.

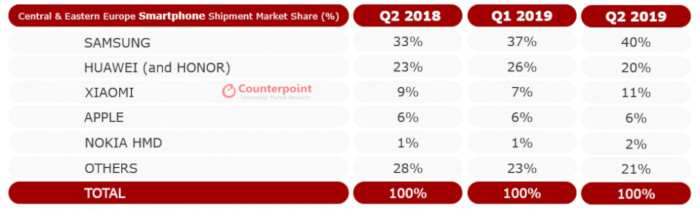

Samsung's smartphone exports to Central and Eastern Europe accounted for 40 percent of the market in the April-June period, up from 33 percent a year earlier, according to a report released by market researcher Counterpoint Research. The company's share was twice that of Huawei of China's 20 percent.

The Korean tech firm posted the strong performance despite flattening smartphone demand in the region, led by solid sales of its mid-range Galaxy A series. Nearly 70% of Samsung’s shipments came from the A-series. Specs like triple camera, in-display fingerprint, excellent build quality, AMOLED display, and more, at competitive prices, helped the A-series capture a significant share in the market. Samsung’s Galaxy A50 was the most successful individual model. Apart from capturing volumes from Huawei, Samsung also won some share from local brands.

"Samsung benefited from the drop in Huawei's volumes after the US' trade ban," Counterpoint Research said in the report. "Excellent traction for its refreshed A-series also helped the company's performance in the region."

Samsung was able to attract European consumers with its affordable A series, which took up nearly 70 percent of its smartphone shipments in the region, the research firm said.

Although Samsung has a sizeable lead in the CEE smartphone market, it needs to brace itself for the competition from Huawei, OPPO, Vivo, Xiaomi, and Realme (HOVXR). As smartphone sales stagnate in their home market, Chinese brands are actively seeking new regions for growth. HOVXR have been particularly aggressive in the CEE region, when it comes to new launches, the opening of flagship stores, marketing and more.

Chinese brands as a whole, grew 11% YoY and 5% QoQ in Q2 2019, despite the decline of Huawei’s volumes. Xiaomi, in particular, has been doing well in the region and is now a firm number three, ahead of Apple. Its volumes grew at a healthy rate of 33% YoY and 69% QoQ. It was also a beneficiary of the US’ trade ban on Huawei. New launches like Redmi 7A and the Mi 9T helped it gain share. Xiaomi has also been very aggressive in Russia and plans to open more than 100 stores across the country by the end of 2019.

Commenting on the Chinese brands, Abhilash Kumar, Research Analyst said, “People in Central and Eastern Europe prefer buying low-mid tier phones. This has been advantageous for Chinese brands that have a huge portfolio in these price bands. Chinese brands, apart from Huawei, grew fast from a low base, 50% YoY and 70% QoQ. Brands like OPPO, Vivo, OnePlus, and ZTE are snatching away market share from local brands. However, their shares remain small and most continue to be outside the top five in terms of market share.”