TSMC Remains Open to New Businesses, Despite Strong Growth

Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract manufacturer, is open to acquisitions of new businesses, although it moved back from bidding for Toshiba's memory business, while it also enjoys strong semiconductor orders from Apple, Qualcomm and NVIDIA.

Speaking on Thursday during the company's annual general meeting, TSMC Chairman Morris Chang said that future acquisitions are an option, as demand for smartphones and other electronics softens.

TSMC, which commands a 56% global market share, had not made any acquisitions to date. On the other hand, rivals Intel and Samsung Electronics are more aggressive in expanding through buyouts.

Earlier this year, TSMC decided against making an offer for the memory chip unit of troubled Japanese conglomerate Toshiba. "Our team studied Toshiba thoroughly for six to seven weeks and talked to every key person," Chang told shareholders and was quoted by Nikkei.

"Even though we eventually decided not to pursue Toshiba as there is no synergy with our long-term strategic growth, we will continue to look for new opportunities from time to time. There are still a lot of good targets out there," he said.

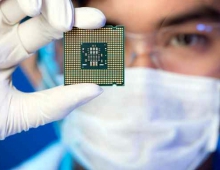

TSMC is focused on making advanced semiconductor components including core processors and graphic processors. It enjoys a monopoly in making core processor chips for the new iPhone range to be launched this year. It also supplies to Qualcomm, Nvidia, Broadcom, MediaTek, Huawei Technologies' chip arm Hisilicon Technologies and some 450 customers worldwide.

Chang pinpointed four major growth segments: mobile, high-performance computing, automotive and Internet-of-Things platforms.

He said he was optimistic that the semiconductor industry would continue to progress, in spite of certain physical limitations ahead.

However, it would take eight to 10 years before semiconductor material and technology hit these physical limitations when it comes to two-dimension chip scaling, Chang said.

There is also 3D packaging by stacking chips up, which will enable Moore?s Law to keep moving forward, for a longer period of time, he added.

Chang believes that his company will outgrow the industry, with a 5% to 10% rise in revenue every year till 2020.

Intel mainly makes chip for its own use under its own brand and it now provides baseband modem chips for iPhones, while Samsung is the world's no.1 memory chipmaker. Both firms are eager to grow their foundry business and make chips for other customers, a market in which TSMC is the leader.