TSMC Sells LED Unit to Epistar

Taiwan Semiconductor Manufacturing will sell its LED subsidiary to fellow Taiwan-based company Epistar, the companies announced Friday. The move follows TSMC's previous effort to become a major player in the light-emitting diode business, which proved unsuccessful. The semiconductor company was a late entrant to the field and struggled in an oversupplied market. Six years after its foray into the sector, the sale of its entire stake in TSMC Solid State Lighting marks a full withdrawal.

Epistar Corp.will pay NT$825 million (US$25.8 million) for the acquisition of TSMC Solid State Lighting Ltd. and will hold a 94 percent stake of the company.

TSMC Solid State Lighting specializes in LED epitaxy manufacturing and assembly.

Last year, Epistar merged with FOREPI in order to increase production capacity, manage cost, and consolidate orders and product lines.

Epistar is also presently moving away from 6" sapphire wafer production, and with this newest merger it will be able to race ahead of the learning curve for the manufacturing of larger wafers and make further advancements in wafer level package. At the same time, Epistar’s acquisition also show that it has created a geographical advantage to reach its epi wafer production target, considering that TSMC SSL has the sophisticated facilities and the perfect location to establish a firm production base close to home.

"In addition to strengthening Epistar's operations, the sale of the lighting unit is the best path for employees and shareholders," said TSMC Solid State Lighting Chairman Stephen Tso.

He said the company will be jointly led by its original management team and Epistar.

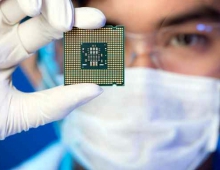

In related news, TSMC and United Microelectronics Corp. (UMC) posted record highs for sales in a single quarter in the fourth quarter of 2014, driven mainly by strong demand for chips made from their high-end processes.

TSMC announced Friday that it had posted consolidated sales of NT$222.52 billion (US$6.95 billion) in the October-December period, up 6.44 percent from a quarter earlier.

The fourth quarter sales hit a record quarterly high but also beat TSMC's earlier sales forecast ranging between NT$217 billion and NT$220 billion.

Analysts said Apple placed more orders with TSMC in the fourth quarter for chips using the maker's 20 nanometer process, resulting in higher shipments for the Taiwanese supplier.

Also on Friday, UMC announced consolidated sales of NT$37.24 billion for the fourth quarter, up 5.74 percent from a quarter earlier.

The growth reflected strong demand for chips made using UMC's 28nm process.