Microsoft Will Up Semiconductor Spending Next Year

Microsoft and Dell are showing divergent spending patterns on semiconductor chips this year as they retool strategies in a once-flourishing PC industry humbled by mobile devices.

Microsoft will be increasing its spending on wireless

applications, even as Dell fails to revive spending despite

releasing new tablets, according to insights from the

Semiconductor Design and Spend Analysis service of IHS Inc.

Microsoft's acquisition of Nokia earlier this year is elevating the creator of Windows software to the Top 10 among overall original equipment manufacturers (OEM) in terms of semiconductor spending. According to IHS, Microsoft will spend an estimated $5.90 billion next year on semiconductors, up from $3.55 billion in 2012 prior to the Nokia deal and from $3.78 billion this year.

The massive spending will put the Redmond, Wash., company in eighth place overall by 2014. Microsoft?s new higher standing in 2014 also means it will be vying for fourth place in chip spending for wireless applications?along with a group of companies including ZTE, LG Electronics, TCL, and Ericsson - behind market leaders Apple, Samsung Electronics and Huawei Technologies of China. Last year Microsoft ranked 15th overall and had no wireless communications spending. Nokia, meanwhile, spent $3.10 billion on its own in 2012 prior to being acquired by Microsoft.

Compared to Microsoft, Dell is nowhere near its peak OEM spending in 2010 of $10.69 billion. In fact, spending by Dell shrank in the double digits during 2011 and 2012, remains basically flat this year, and is forecast to dip 5 percent in 2014 to $8.24 billion.

The two titans have faltered in their main PC business as smartphones and tablets have taken over among consumers.

For Microsoft, approximately 37 percent of its $5.9 billion spend in 2014 - or an amount equivalent to $2.2 billion - will be spent next year on chips for wireless devices like smartphones and tablets. Microsoft is enjoying success with its Nokia Windows phones even though they run a distant third behind Apple and Android-based smartpohnes, but the company has had a rougher time with its Surface tablets against Apple's iPad and Samsung's Galaxy tablet offerings.

One challenge for Microsoft will be in formulating a strategy for success and deeper penetration of its smartphone and tablet lines. The maker will also need to figure out how to address the problematic position of continuing to license Windows systems to other OEMs with devices with which Microsoft actively competes.

Dell's fortunes have taken a hit since it ruled the PC industry years ago, and questions on how to fix an ailing PC business continue to hound the company, now taken private after a shareholder vote in September.

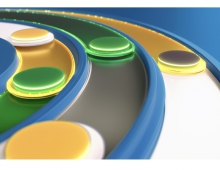

For Dell?s semiconductor spend this year, 94 percent will be in the three areas of microcomponent integrated circuits, memory and logic, with the remaining 6 percent to flow to discretes, analog, optical chips, and sensors and actuators.

Dell is also making a renewed effort to develop a more active mobile portfolio, even though smartphones and tablets have not performed well historically for the computer maker.

However, the company is announcing new tablet devices due out in November, including 7- and 11-inch versions based on the Windows 8.1 and Android operating systems. It will also launch new laptops with touch-screen capability to better compete in the weak but still crowded PC space.

Microsoft's acquisition of Nokia earlier this year is elevating the creator of Windows software to the Top 10 among overall original equipment manufacturers (OEM) in terms of semiconductor spending. According to IHS, Microsoft will spend an estimated $5.90 billion next year on semiconductors, up from $3.55 billion in 2012 prior to the Nokia deal and from $3.78 billion this year.

The massive spending will put the Redmond, Wash., company in eighth place overall by 2014. Microsoft?s new higher standing in 2014 also means it will be vying for fourth place in chip spending for wireless applications?along with a group of companies including ZTE, LG Electronics, TCL, and Ericsson - behind market leaders Apple, Samsung Electronics and Huawei Technologies of China. Last year Microsoft ranked 15th overall and had no wireless communications spending. Nokia, meanwhile, spent $3.10 billion on its own in 2012 prior to being acquired by Microsoft.

Compared to Microsoft, Dell is nowhere near its peak OEM spending in 2010 of $10.69 billion. In fact, spending by Dell shrank in the double digits during 2011 and 2012, remains basically flat this year, and is forecast to dip 5 percent in 2014 to $8.24 billion.

The two titans have faltered in their main PC business as smartphones and tablets have taken over among consumers.

For Microsoft, approximately 37 percent of its $5.9 billion spend in 2014 - or an amount equivalent to $2.2 billion - will be spent next year on chips for wireless devices like smartphones and tablets. Microsoft is enjoying success with its Nokia Windows phones even though they run a distant third behind Apple and Android-based smartpohnes, but the company has had a rougher time with its Surface tablets against Apple's iPad and Samsung's Galaxy tablet offerings.

One challenge for Microsoft will be in formulating a strategy for success and deeper penetration of its smartphone and tablet lines. The maker will also need to figure out how to address the problematic position of continuing to license Windows systems to other OEMs with devices with which Microsoft actively competes.

Dell's fortunes have taken a hit since it ruled the PC industry years ago, and questions on how to fix an ailing PC business continue to hound the company, now taken private after a shareholder vote in September.

For Dell?s semiconductor spend this year, 94 percent will be in the three areas of microcomponent integrated circuits, memory and logic, with the remaining 6 percent to flow to discretes, analog, optical chips, and sensors and actuators.

Dell is also making a renewed effort to develop a more active mobile portfolio, even though smartphones and tablets have not performed well historically for the computer maker.

However, the company is announcing new tablet devices due out in November, including 7- and 11-inch versions based on the Windows 8.1 and Android operating systems. It will also launch new laptops with touch-screen capability to better compete in the weak but still crowded PC space.