ASML Reports Record Sales for 2015

Dutch manufacturer of computer chip making systems ASML Wednesday announced 2015 a "record" year for sales which rose to 6.3 billion euros ($6.9 billion), with net profits leaping by 15 percent. "Our full-year 2015 net sales marked a new record at EUR 6.3 billion, up from EUR 5.9 billion in 2014, including service and field option sales that rose to a record EUR 2 billion. We expect 2016 first-quarter sales at approximately EUR 1.3 billion. As we indicated three months ago, we expect our logic customers to take shipments of our leading edge immersion tools in the second quarter in preparation of their 10 nanometer node ramp. As a result, we expect second-quarter sales to increase significantly from the first-quarter level," ASML President and Chief Executive Officer Peter Wennink said.

ASML makes systems for manufacturing processor chips as well as memory chips such as DRAM and SRAM, essential for mobile phones and tablets.

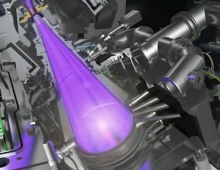

During 2015, ASML began ramping shipments of the TWINSCAN NXT:1980, the company's most advanced immersion system, shipping five systems.

In Holistic Lithography, which grew by over 20 percent in revenue in 2015, the company saw increased adoption of its latest metrology systems and control software at both logic and memory customers.

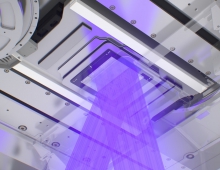

Extreme Ultraviolet (EUV) lithography met its 2015 productivity and availability targets. ASML had already achieved a productivity of more than 1,000 wafers per day early in 2015 on the NXE:3300B system and improved this to more than 1,250 wafers per day in the fourth quarter on the successor system, the NXE:3350B. In addition, the availability of systems in the field improved, with the majority of systems achieving a four-week availability of more than 70 percent in recent months. ASML also shipped two of its latest NXE:3350B EUV systems and started shipping the third in 2015.

For the first-quarter of 2016, ASML expects net sales at approximately EUR 1.3 billion, a gross margin of around 42%, R&D costs of about EUR 275 million, other income of about EUR 23 million, SG&A costs of about EUR 90 million and an effective annualized tax rate of around 13%.