Smartphone Chips to Help TSMC Dethrone Intel in Chipmaking Market

Intel sees its 30-year chipmaking dominance unde threat, as the PC market shrinks and Taiwan Semiconductor Manufacturing Co (TSMC) keeps moving on to te development of more advanced chips mainly for smartphones.

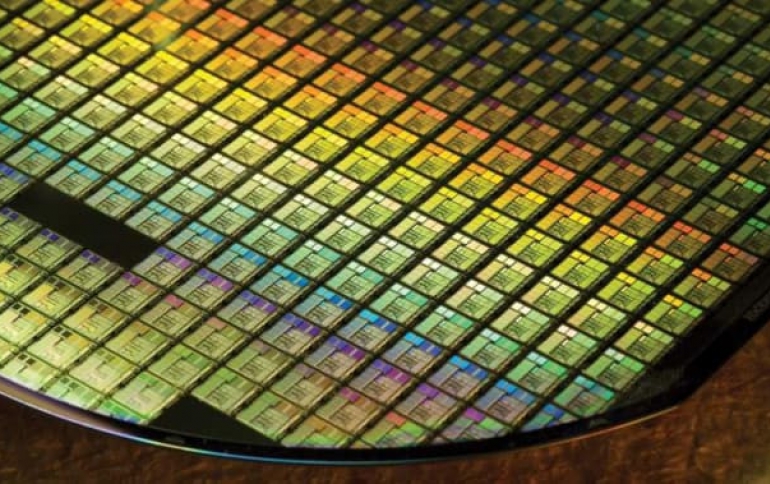

Intel has been the largest chipmaker computers and servers. TSMC was created in 1987 to manufacrure chips designed from companies that lacked the money to build their own factories.

Currently, TSMC's list of clients include AMD, Apple Inc and Qualcomm Inc. The Taiwanses foundry has gained experience and technical know-how to churn out the smallest, most efficient and powerful chips in the highest volumes.

As a result, TSMC has a real chance to replace Intel as the best chipmaker in the business. Last year, the Taiwanese company amassed a bigger market value than its US rival for the first time.

In addition, the largest Internet companies (Amazon, Google, Facebook) have started making their own chips.

Earlier this week, Amazon.com announced Graviton, its first in-house server processor. The Graviton is made by TSMC and it supports a new version of Amazon’s service that is more than 40 percent cheaper than a similar offering powered by Intel chips.

Intel was the first to use 14nm technology at scale in 2013. But since then, the company has not managed to deliver denser chips, and instead optimizes the existing 14nm designs.

Intel’s holdup revolves around yield, the number of good chips that emerge from each production run.

The company will not have a 10-nanometer process ready for prime time until the end of next year.

TSMC has gone from producing 20nm to 7nm chips in the same time.

Intel's rival in the PC market, AMD, is trying to challenge Intel. The company is confident that its latest chip designs will surpass those from Intel. TSMC makes this competition possible, even though AMD has about one-10th of Intel’s workforce and research and development budget.

TSMC is catching up Intel as a result of the demand for smartphones. Handset makers used processors from companies like Qualcomm, or they designed their own using ARM technology, like Apple. These chips were made in TSMC's factories.

Intel had chosen not to develop mobile chips - or it simply couldn't compete with other chip architectures in terms of energy efficiency. As a result, it prioritized its existing cash cows of PC and server chip businesses.

The smartphone business is now almost six times as big as the PC industry by volume. That has given TSMC the advantage of high-volume manufacturing experience that previously belonged to Intel.

While Intel still spend more than TSMC on new plants and equipment, the tables are turned when you combine the research budgets of TSMC clients like Qualcomm, Apple, Nvidia Corp and Huawei Technologies Co.