Apple Leads in Global Chip Spending

Apple is not only the world's leading original equipment manufacturer (OEM) in terms of semiconductor purchasing, the company also is increasing its buying at a faster rate than other top firms, solidifying its hegemony over the chip market.

Apple this year is expected to buy nearly $28 billion worth of semiconductors, up 15 percent from $24 billion in 2011, according to an IHS iSuppli OEM Semiconductor Spend Analysis report from information and analytics provider IHS. This means that Apple will dramatically outperform the No. 2 purchaser, Samsung Electronics Co. Ltd., allowing it to remain the world's top OEM semiconductor buyer?a position it has held since 2010.

Apple is maintaining its lead in semiconductor purchasing because of continuing strong demand for its products, combined with the company's capability to maintain beneficial relationships with more than 150 suppliers that provide components or offer manufacturing and assembly services.

Apple is also outgrowing the other OEMs and making gains in the various regions of the world. For Apple, this translates into competitive advantages when it comes to manufacturing electronic products.

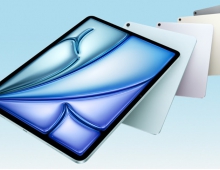

"It's well known that Apple has already conquered the smartphone and tablet segments' but behind the scenes the company is engaging in another kind of conquest: the dominance of the electronics supply chain," said Myson Robles-Bruce, senior analyst for semiconductor spending and design activity at IHS. "Such a dominant position provides critical benefits, allowing one to dictate semiconductor pricing, control product roadmaps and obtain guaranteed supply and delivery. For Apple, these benefits translate into competitive advantages, letting it offer more advanced products at lower prices, faster and more reliably than the competition."

Beyond its No.1 position worldwide, Apple also is expected to achieve the strongest growth in chip spending among the globe's Top 10 OEM semiconductor buyers. In fact, Apple is set to increase its chip buying at a rate nearly three times faster than the next-fastest-rising purchaser, No. 8 ranked Canon, which will see a 4.6 percent increase this year.

Of the four major electronics production regions, Apple is expected to achieve the fastest growth in semiconductor purchasing among the Top 10 OEMs in two areas: the Americas and EMEA (Middle East and Africa). Apple is set to attain the second fastest-growth in a third geography, the key Asia-Pacific region, which now is the world's dominant electronics producer. Only in Japan was Apple not among the fastest-growing chip purchasers.

According to IHS, Apple ranks among the Top 10 semiconductor purchases in three out of the four major global regions. The company is positioned at No.1 among all chip buyers in the Asia-Pacific region, No. 2 in the Americas, and No. 6 in EMEA.

Apple is expected to come in second behind Cisco in the Americas in 2012. However, Apple is closing the gap, with Cisco expected to post a 5 percent decrease in semiconductor buying in 2012. Still, Cisco holds a more than $1 billion lead over Apple is U.S. chip purchasing.

Cisco leads Apple in the U.S. because it maintains a larger number of design centers there. The company also has higher spending on consumer electronics-related chips for set-top boxes, and it makes large semiconductor purchases in support of its business in wired communications equipment in the region.

Apple is set to expand its lead in global chip purchasing in 2013, with growth of 12.3 percent once again leading the Top 10 OEM semiconductor purchasers.

"Apple will continue to outgrow the other major OEMs in chip purchasing because of its clear vision of the future, which extends a few years out. This vision includes a strategy to not only update currently popular products but also achieve success in other areas of interest like the television segment," Robles-Bruce said.

Apple is maintaining its lead in semiconductor purchasing because of continuing strong demand for its products, combined with the company's capability to maintain beneficial relationships with more than 150 suppliers that provide components or offer manufacturing and assembly services.

Apple is also outgrowing the other OEMs and making gains in the various regions of the world. For Apple, this translates into competitive advantages when it comes to manufacturing electronic products.

"It's well known that Apple has already conquered the smartphone and tablet segments' but behind the scenes the company is engaging in another kind of conquest: the dominance of the electronics supply chain," said Myson Robles-Bruce, senior analyst for semiconductor spending and design activity at IHS. "Such a dominant position provides critical benefits, allowing one to dictate semiconductor pricing, control product roadmaps and obtain guaranteed supply and delivery. For Apple, these benefits translate into competitive advantages, letting it offer more advanced products at lower prices, faster and more reliably than the competition."

Beyond its No.1 position worldwide, Apple also is expected to achieve the strongest growth in chip spending among the globe's Top 10 OEM semiconductor buyers. In fact, Apple is set to increase its chip buying at a rate nearly three times faster than the next-fastest-rising purchaser, No. 8 ranked Canon, which will see a 4.6 percent increase this year.

Of the four major electronics production regions, Apple is expected to achieve the fastest growth in semiconductor purchasing among the Top 10 OEMs in two areas: the Americas and EMEA (Middle East and Africa). Apple is set to attain the second fastest-growth in a third geography, the key Asia-Pacific region, which now is the world's dominant electronics producer. Only in Japan was Apple not among the fastest-growing chip purchasers.

According to IHS, Apple ranks among the Top 10 semiconductor purchases in three out of the four major global regions. The company is positioned at No.1 among all chip buyers in the Asia-Pacific region, No. 2 in the Americas, and No. 6 in EMEA.

Apple is expected to come in second behind Cisco in the Americas in 2012. However, Apple is closing the gap, with Cisco expected to post a 5 percent decrease in semiconductor buying in 2012. Still, Cisco holds a more than $1 billion lead over Apple is U.S. chip purchasing.

Cisco leads Apple in the U.S. because it maintains a larger number of design centers there. The company also has higher spending on consumer electronics-related chips for set-top boxes, and it makes large semiconductor purchases in support of its business in wired communications equipment in the region.

Apple is set to expand its lead in global chip purchasing in 2013, with growth of 12.3 percent once again leading the Top 10 OEM semiconductor purchasers.

"Apple will continue to outgrow the other major OEMs in chip purchasing because of its clear vision of the future, which extends a few years out. This vision includes a strategy to not only update currently popular products but also achieve success in other areas of interest like the television segment," Robles-Bruce said.