IBM Launches Blockchain World Wire, a Global Payment Network

IBM has launched IBM Blockchain World Wire, a global blockchain network for cross-border payments that will use both stable coin backed by U.S. dollars and cryptocurrency to make near real-time cross border financial transactions.

Designed to optimize and accelerate foreign exchange, cross border payments and remittances, World Wire integrates payment messaging, clearing and settlement on a single unified network, while allowing participants to dynamically choose from a variety of digital assets for settlement.

Retail remittance networks using IBM's Blockchain World Wire are the equivalent of Moneygram or Western Union.

"We've created a new type of payment network designed to accelerate remittances and transform cross-border payments to facilitate the movement of money in countries that need it most," said Marie Wieck, General Manager, IBM Blockchain. "By creating a network where financial institutions support multiple digital assets, we expect to spur innovation and improve financial inclusion worldwide."

Today World Wire has enabled payment locations in 72 countries, with 47 currencies and 44 banking endpoints.

World Wire uses the Stellar protocol, a decentralized payment network that uses its own cryptocurrency, Stellar Lumens (XLM). The protocol

makes money transfers point-to-point in lieu of the complexities of conventional correspondent banking. It reduces intermediaries and allows users to accelerate settlement time often in seconds by transmitting monetary value in the form of digital assets, commonly known as cryptocurrencies or "stable coins." This simplified approach improves operational efficiency and liquidity management, streamlining payment reconciliation and reducing overall transaction costs for financial institutions.

The network already supports settlement using Stellar Lumens and a U.S. dollar stable coin through IBM's collaboration with Stronghold. Pending regulatory approvals and other reviews, six international banks, including Banco Bradesco, Bank Busan, and Rizal Commercial Banking Corporation (RCBC), have signed letters of intent to issue their own stable coins on World Wire, adding Euro, Indonesian Rupiah, Philippine Peso, Korean Won and Brazilian Real stable coins to the network. IBM will continue to expand the ecosystem of settlement assets based on client demand.

How it works

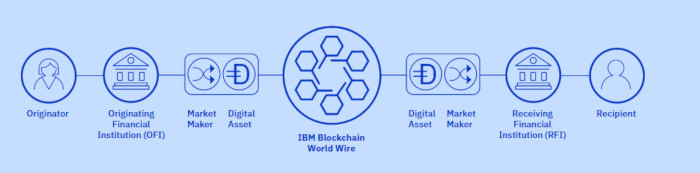

Two financial institutions transacting together agree to use a stable coin, central bank digital currency or other digital asset as the bridge asset between any two fiat currencies. The digital asset facilitates the trade and supplies important settlement instructions.

The institutions use their existing payment systems – connected to World Wire’s APIs – to convert the first fiat currency into the digital asset.

World Wire then simultaneously converts the digital asset into the second fiat currency, completing the transaction. All transaction details are recorded onto an immutable blockchain for clearing.

World Wire is now in limited production and available in a specific countries.

IBM is not the first firm to create a blockchain payments network. In October, J.P. Morgan announced what is arguably one of the largest blockchain payments networks to date.

J.P. Morgan created the Interbank Information Network (IIN), which it said will significantly reduce the number of participants needed to respond to compliance and other data-related inquiries that delay payments.

The Royal Bank of Canada and Australia and the New Zealand Banking Group Ltd. were the first two banks to join the blockchain network, "representing significant cross-border payment volumes."

Then, in February, J.P. Morgan announced its own stable coin – JPM Coin – enabling the instantaneous transfer of payments between institutional accounts. It was the first stable coin announced by a major bank.