TSMC Reports 65 pct Rise in Q1 Profit

Taiwan Semiconductor Manufacturing (TSMC) reported a 65 percent rise in first-quarter net profit on Thursday, boosted by strong sales of iPhones from Apple. The world's largest contract chip manufacturer booked T$79 billion ($2.54 billion) for January-March. The company also reported a quarterly revenue rise of 49.8 percent, as devices from watches to washing machines require more chips.

Shipments of 20-nanometer process technology accounted for 16 percent of TSMC's total wafer revenues in the three months ending on March 31, with 28-nanometer making up 30 percent, TSMC said in a statement.

"The demand for TSMC's wafers remained strong in the first quarter but NT dollar was stronger than the assumption in our first quarter guidance by about 1 percent, which reduced our revenue by NT$1.9 billion," said Lora Ho, SVP and Chief Financial Officer of TSMC.

"In the second quarter, a combination of customers' business loss, inventory adjustment, and a less favorable exchange rate will negatively impact our second quarter business. Based on our current business outlook and exchange rate assumption of 1 US dollar to 31.03 NT dollars, management expects overall performance for second quarter 2015 to be as follows":

- Revenue is expected to be between NT$204 billion and NT$207 billion;

- Gross profit margin is expected to be between 47.5% and 49.5%;

- Operating profit margin is expected to be between 36.5% and 38.5%.

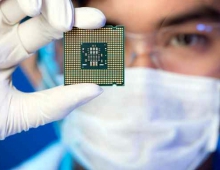

TSMC is facing competition from Samsung and Intel in the race of producing the smallest, most energy-efficient chips.

reports claim that TSMC lost orders to Samsung to produce chips for Apple's next-generation iPhone, likely due out this year.

Samsung also last week said it opted for its own chips for its latest flagship phone over chips from Qualcomm, which contracts a large share of its production to TSMC.