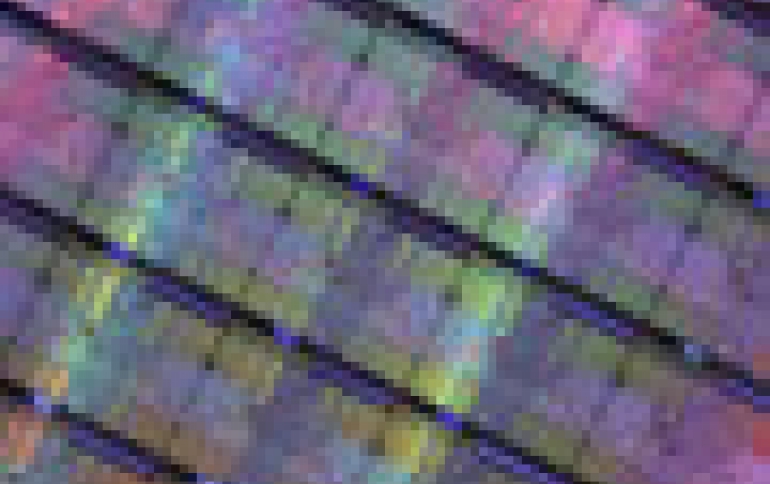

Wafer Fab Equipment Spending to Decline in 2012

Worldwide wafer fab equipment (WFE) spending is on pace to total $33 billion in 2012, a decline of 8.9 percent from 2011 spending of $36.2 billion, according to Gartner, Inc.

Gartner analysts said the market will return to growth in 2013 with WFE spending projected to surpass $35.4 billion, a 7.4 percent increase from 2012.

"In 2012, WFE started off the year strong, as foundries and other logic manufacturers ramped up sub-30-nm production," said Bob Johnson, research vice president at Gartner. "The need for new equipment was stronger than originally anticipated, because strengthening demand for leading-edge devices required higher production volumes as yields had yet to reach mature levels. However, demand for new logic production equipment will soften as yields improve, leading to declining shipment volume for the rest of the year."

Wafer fab manufacturing capacity utilization will decline into the mid-80-percent range by the middle of 2012 before slowly increasing to about 87 percent by the end of 2012. Leading-edge utilization will return to the high-80-percent range by the second half of 2012, and move into the low-90-percent range through 2013, providing for a positive capital investment environment.

"Production is getting back to more-normal levels, following a period of inventory correction," Mr. Johnson said. "Increased demand, combined with less-than-mature yields at the leading edge, is consuming increased capacity, with the result that utilization will begin to climb upward again in the second quarter of 2012. Capital spending restraints through the second half of 2012 will also slow new capacity additions, with the result that overall utilization rates will return to normal levels at the start of 2013. Leading-edge utilization will stay in the low-90-percent range through most of 2013, providing continued impetus for capital investment.

The industry was ramping up different technology nodes in 2011 and will continue to do so in 2012, driving a broad spectrum of equipment segment sales opportunities. The industry had been ramping up different technology nodes in 2011, and that continues in 2012. Foundry is ramping up 28 nm, leading-edge logic has transitioned to 20 nm, NAND flash will ramp up the 1X node, and DRAM will be ramping up 4X and 3X nodes. Gartner analysts said this will create different challenges for the equipment manufacturers because they face different issues at each node.

"In 2012, WFE started off the year strong, as foundries and other logic manufacturers ramped up sub-30-nm production," said Bob Johnson, research vice president at Gartner. "The need for new equipment was stronger than originally anticipated, because strengthening demand for leading-edge devices required higher production volumes as yields had yet to reach mature levels. However, demand for new logic production equipment will soften as yields improve, leading to declining shipment volume for the rest of the year."

Wafer fab manufacturing capacity utilization will decline into the mid-80-percent range by the middle of 2012 before slowly increasing to about 87 percent by the end of 2012. Leading-edge utilization will return to the high-80-percent range by the second half of 2012, and move into the low-90-percent range through 2013, providing for a positive capital investment environment.

"Production is getting back to more-normal levels, following a period of inventory correction," Mr. Johnson said. "Increased demand, combined with less-than-mature yields at the leading edge, is consuming increased capacity, with the result that utilization will begin to climb upward again in the second quarter of 2012. Capital spending restraints through the second half of 2012 will also slow new capacity additions, with the result that overall utilization rates will return to normal levels at the start of 2013. Leading-edge utilization will stay in the low-90-percent range through most of 2013, providing continued impetus for capital investment.

The industry was ramping up different technology nodes in 2011 and will continue to do so in 2012, driving a broad spectrum of equipment segment sales opportunities. The industry had been ramping up different technology nodes in 2011, and that continues in 2012. Foundry is ramping up 28 nm, leading-edge logic has transitioned to 20 nm, NAND flash will ramp up the 1X node, and DRAM will be ramping up 4X and 3X nodes. Gartner analysts said this will create different challenges for the equipment manufacturers because they face different issues at each node.