HDDs Shipments Increased In 2014

After three years of declining hard disk drive shipments, in 2014 the industry shipped 2.2% more hard drives than the prior year. Since 2011, initially as a result of the massive flooding in Thailand that wiped out considerable HDD and HDD component manufacturing capacity, and later due to a shift from laptop to tablet computers, HDD shipments were lower year over year until 2013. In 2014, due to the growth of HDDs in cloud and other enterprise applications and especially the stabilization of the laptop market, total HDD shipments increased to about 564 million units, according to data storage consulting firm Coughlin Associates.

At the same time that HDD shipments recovered, the average sales price for HDDs was stable with increasing ASPs in the last two calendar quarters off-setting lower ASPs in the prior two quarters. This combination of more shipping HDD units and stable ASPs led to good profitability for Seagate and Western Digital (and presumably for Toshiba) in 2014. In 2014 the overall HDD market share, revenue and Exabyte shipments for the three companies gave an almost identical distribution. Tom Cloughin, president of Coughlin Associates, estimates that in 2014 Western Digital has about a 44% market share, followed by Seagate at 40% and Toshiba at 16%.

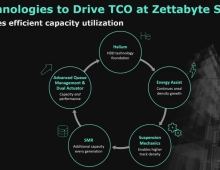

Although flash memory is making inroads on high performance HDD shipments, the recovery in the laptop market and growing needs for massive storage libraries in the cloud and for many emerging enterprise applications will drive HDD shipment and revenue growth for several years to come, assuming continual increases in HDD storage capacities.

The firm predicts a HDD unit shipment growth over the next few years to meet the needs of content creators, with shipments of about 721 million units by 2019. Over the same period, total annual HDD shipments will grow from about 540 Exabytes to close to 2,000 Exabytes (2 Zetabytes).

While not as exciting as in the past with unit and technology growth, HDDs promise a good return on investment for a maturing industry.