Samsung's Fourth Quarter Profit Declined

Samsung Electronics on Friday reported declined quarterly profit, mainly hit by slow smartphone sales.

The company announced revenues of 59.28 trillion Korean won on a consolidated basis for the fourth quarter ended December 31, 2013, which is an increase of 0.3 percent quarter-on-quarter. For the quarter, the company posted consolidated operating profits of 8.31 trillion won, representing an 18-percent decline Q-o-Q.

The fourth quarter results brought Samsung's full year 2013 revenue to an all-time high of 228.69 trillion won, up 14 percent from the previous year. Year-end net income registered 30.47 trillion won and Samsung netted 36.79 trillion won in operating profit, a 27-percent on-year increase.

In 2013, Samsung maintained its market leadership in mobile devices as evidenced by its smartphone market shares of over 30-percent for both developed and emerging markets, and a two-fold surge in tablet sales from the previous year due to the release of new products such as GALAXY Tab 3 and GALAXY Note 10.1 (2014 Edition).

The Consumer Electronics division - encompassing the Visual Display and Digital Appliances businesses - posted an operating profit of 660 billion won which was an 88-percent increase on the previous quarter. Revenue was 14.27 trillion won, an increase of 18 percent quarter-on-quarter.

Samsung's TV panel shipments decreased on-quarter in the low single-digit percentage range, although shipments were higher than the corresponding quarter of the previous year. Samsung saw growth in developed markets in the quarter thanks to premium products that boosted growth by 90 percent from the July-September quarter. Orders for 60-inch and larger TVs recorded 80-percent growth while demand for Smart TVs grew by more than 60 percent in the fourth quarter.

Profit margins for the company's Digital Appliances Business remained steady in the quarter led by increased sales of premium products in developed markets.

On the components' side, inventory adjustments and a retreat in panel price took their toll on the Display Panel segment?s overall earnings but increased shipments of IT and UHD TV panels were a silver lining.

For the Memory business, revenue in the fourth quarter landed in positive territory with cutting-edge process and high-margin DRAM and NAND Flash memory chip products. Samsung's memory chip business claimed the bulk of sales with 6.52 trillion won in revenue, a 2-percent increase in gains quarter-on-quarter. As for NAND, Samsung's 10-nanometer-class portion increased while profit was enhanced through sales expansion of solution products, including SSD.

As for System LSI, fourth quarter revenue slightly increased compared to the third quarter led by increased AP shipments for new products.

"Amid macroeconomic uncertainties such as a strong Korean won and increased concerns over possible quantitative easing (QE) tapering in the U.S., our earnings were lower than what the market expected due to a negative currency impact of around 700 billion won and a significant one-off expense of about 800 billion won, however, fourth quarter operational results were respectably strong. Looking at the quarterly earnings trend, we expect 2014 to follow last year's pattern of a weak first half and a strong second half as usual," said Robert Yi, Senior Vice President and Head of Investor Relations.

For the first quarter, it will be challenging for Samsung to improve its earnings in the first quarter as the weak seasonality of the IT industry will put pressure on demand for components and TV products.

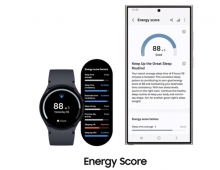

For 2014, Samsung is looking to maintain its leadership in the smartphone business, increase its business footprint in the wearable device category with new products and ramp up its tablet lineup with mid- to low-end models and larger screens. The company will focus on expanding its smartphone portfolio both by region and price range, and respond to growing LTE demand in Europe and China. Samsung also said it planned to lower its mobile marketing spend this year relative to revenue, after big promotional spending hit fourth-quarter profit.

This year also looks more promising for the UHD, curved and 60-inch and over TVs due to the upcoming world soccer championship in Brazil and the anticipated expansion of the UHD TV market.

Meanwhile, Samsung plans to use OLED panels in products other than smartphones, including tablets and wearable devices. Furthermore, the company plans to achieve mass production of higher-quality flexible panels.

On the components? side, Samsung plans to secure profitability in the semiconductor market with high-margin memory processes, diverse product offerings and the production of V-NAND. Samsung will try to stay ahead of the race in logic chips or System LSI with 20-nanometer-class AP and by solidifying growth potential by migrating to the 14-nanometer-class process.

The fourth quarter results brought Samsung's full year 2013 revenue to an all-time high of 228.69 trillion won, up 14 percent from the previous year. Year-end net income registered 30.47 trillion won and Samsung netted 36.79 trillion won in operating profit, a 27-percent on-year increase.

In 2013, Samsung maintained its market leadership in mobile devices as evidenced by its smartphone market shares of over 30-percent for both developed and emerging markets, and a two-fold surge in tablet sales from the previous year due to the release of new products such as GALAXY Tab 3 and GALAXY Note 10.1 (2014 Edition).

The Consumer Electronics division - encompassing the Visual Display and Digital Appliances businesses - posted an operating profit of 660 billion won which was an 88-percent increase on the previous quarter. Revenue was 14.27 trillion won, an increase of 18 percent quarter-on-quarter.

Samsung's TV panel shipments decreased on-quarter in the low single-digit percentage range, although shipments were higher than the corresponding quarter of the previous year. Samsung saw growth in developed markets in the quarter thanks to premium products that boosted growth by 90 percent from the July-September quarter. Orders for 60-inch and larger TVs recorded 80-percent growth while demand for Smart TVs grew by more than 60 percent in the fourth quarter.

Profit margins for the company's Digital Appliances Business remained steady in the quarter led by increased sales of premium products in developed markets.

On the components' side, inventory adjustments and a retreat in panel price took their toll on the Display Panel segment?s overall earnings but increased shipments of IT and UHD TV panels were a silver lining.

For the Memory business, revenue in the fourth quarter landed in positive territory with cutting-edge process and high-margin DRAM and NAND Flash memory chip products. Samsung's memory chip business claimed the bulk of sales with 6.52 trillion won in revenue, a 2-percent increase in gains quarter-on-quarter. As for NAND, Samsung's 10-nanometer-class portion increased while profit was enhanced through sales expansion of solution products, including SSD.

As for System LSI, fourth quarter revenue slightly increased compared to the third quarter led by increased AP shipments for new products.

"Amid macroeconomic uncertainties such as a strong Korean won and increased concerns over possible quantitative easing (QE) tapering in the U.S., our earnings were lower than what the market expected due to a negative currency impact of around 700 billion won and a significant one-off expense of about 800 billion won, however, fourth quarter operational results were respectably strong. Looking at the quarterly earnings trend, we expect 2014 to follow last year's pattern of a weak first half and a strong second half as usual," said Robert Yi, Senior Vice President and Head of Investor Relations.

For the first quarter, it will be challenging for Samsung to improve its earnings in the first quarter as the weak seasonality of the IT industry will put pressure on demand for components and TV products.

For 2014, Samsung is looking to maintain its leadership in the smartphone business, increase its business footprint in the wearable device category with new products and ramp up its tablet lineup with mid- to low-end models and larger screens. The company will focus on expanding its smartphone portfolio both by region and price range, and respond to growing LTE demand in Europe and China. Samsung also said it planned to lower its mobile marketing spend this year relative to revenue, after big promotional spending hit fourth-quarter profit.

This year also looks more promising for the UHD, curved and 60-inch and over TVs due to the upcoming world soccer championship in Brazil and the anticipated expansion of the UHD TV market.

Meanwhile, Samsung plans to use OLED panels in products other than smartphones, including tablets and wearable devices. Furthermore, the company plans to achieve mass production of higher-quality flexible panels.

On the components? side, Samsung plans to secure profitability in the semiconductor market with high-margin memory processes, diverse product offerings and the production of V-NAND. Samsung will try to stay ahead of the race in logic chips or System LSI with 20-nanometer-class AP and by solidifying growth potential by migrating to the 14-nanometer-class process.