TSMC Expected to Enjoy Significant Growth in 2020 on Demand for Advanced Chips

Taiwan Semiconductor Manufacturing Company (TSMC) is expected to see a strong rebound starting next year as fabless companies such as AMD grab market share from Intel.

Key TSMC customers such as AMD, Apple, HiSilicon, Nvidia and Qualcomm are expected to increase their orders on market share gains and high growth in end markets.

In case of AMD, the company is exprcted to continue to see some share gains particularly in CPUs both in servers and PCs, as a result of Intel’s recent struggles to advance its manufacturing. About 50% of AMD’s sales use TSMC’s 7nm production, but nearly all of AMD’s output is expected to be made at leading-edge nodes by 2021. That would further boost TSMC's sales.

AMD will also provide the chips for the Xbox Series X and the PS5. This means that AMD will see a steep ramp in console-related silicon sales in the second half of 2020 and in 2021. All of those chips will be made using TSMC’s 7nm+ capacity.

Chinese chip design companies account for about 20 percent of TSMC’s demand. China is seeking for semiconductor independence from the west and that domestic like SMIC still lag three generations behind TSMC and face hurdles in catching up, especially after the U.S. government blocked SMIC from acquiring EUV lithography equipment from ASML.

The U.S. may also clamp down on TSMC’s sales to HiSilicon, the chipmaking arm of Huawei. TSMC uses its 7nm process to make HiSilicon’s Kirin 980 processor for 5G smartphones. HiSilicon, which accounts for about 15 percent of TSMC’s demand, is TSMC’s second-largest customer after Apple. Potential U.S. restrictions on TSMC sales to HiSilicon would be a downside for the Taiwan chipmaker during the near term.

Apple, another TSMC client, is said to eventually combine its MacOS and iOS and shift production from Intel to internally developed Arm-based processors for its PCs. That shift will increase Apple’s demand with foundries.

Apple will also equip its upcoming iPhones with 5G modems, provided by Qualcomm - a TSMC client. That move will possibly provide as much as $2 billion in sales to foundries in light of higher 5G modem expenses, and TSMC is likely to be the largest beneficiary of the shift.

Nvidia has been a client of both TSMC and Samsung for data-center related chips, and such orders are expected to double in 2021.

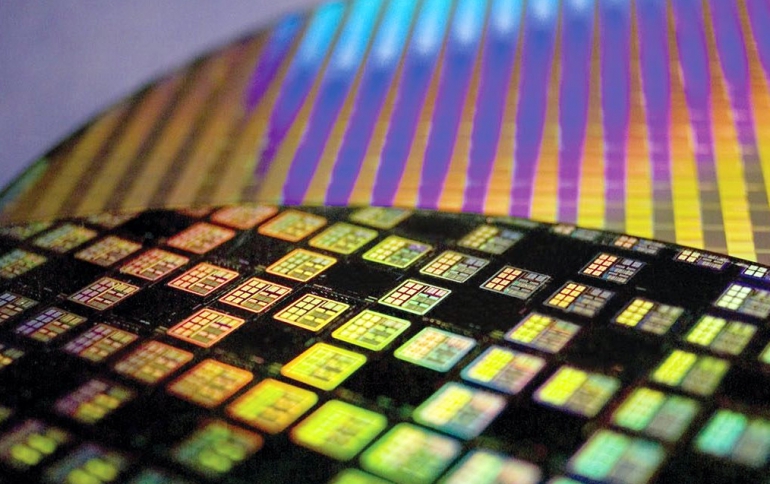

About a third of TSMC’s production is on sub-10nm nodes with TSMC likely to exit the year with close to 50 percent of production on sub-10nm processes as 5nm production ramps.

In contrast, excluding Samsung, TSMC’s competitors remain on 10nm+ process nodes. GlobalFoundries, the third largest foundry, decided not to pursue advanced node progression in 2018 and instead to focus on lagging nodes.

Most of Intel’s production remains on 14nm parts. While Intel’s 14nm process roughly maps to TSMC’s 10nm technology, TSMC is currently in the lead with 7nm.