HDD Sales Fall, Capacities Rise

The HDD shipments across the board for all HDD applications were down 12.3% over the prior quarter, but the average HDD capacities increased quarter over quarter. According to the CQ1 2016 results reported by Seagate, the average shipped capacity increased from 1.32 TB to 1.42 TB, a 7.6% increase. Western Digital average shipped capacity increased from 1.39 TB to 1.44 TB, a 3.6% increase.

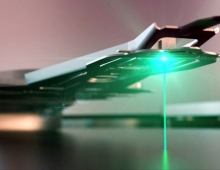

During the quarter, Seagate joined Western Digital in announcing it was shipping 10 TB He-filled HDDs, currently the peak HDD capacity point, for the enterprise Near-Line and Active Archive storage markets.

According to Tom Coughlin, chairman of the Storage Visions, it is unlikely that we will see average growth in HDD shipped units of 15% or more in the foreseeable future.

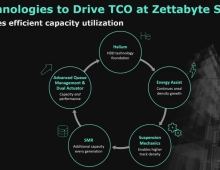

On the other hand it is unlikely that we will see a total displacement of HDD either, as long as the storage capacity of HDDs can advance by at least 30% annually and thus match the average increases for flash memory.

HDDs are expected to decline for client computer applications as the price of a useful flash amount of memory storage capacity decreases.

HDDs and other storage for consumer electronic applications, such as DVRs will decline with the introduction into more markets of cloud driven network DVR where the recording is done in a data center rather than a set top box. Network DVRs will increase the demand for near-line HDD storage in the cloud.

Where HDDs appear to have growth potential is in applications where the price of storage is more important than the storage performance. This is where external (branded) storage is attractive for many consumers as well as high capacity near-line storage products (like those 10 TB He-filled HDDs) for enterprise applications.