LG Display Warns of Panel Price Weakness

LG Display on Wednesday warned of weaker panel prices in the year ahead due to global economic uncertainty and U.S.- China trade tensions, as it posted increased quarterly profit thanks to sales of wearable screens.

The company said strong sales of high-end screens for smart watches helped improve profitability, even as overall sales fell due to weakness in the television segment.

The company's revenues in the fourth quarter of 2018 increased by 14% to KRW 6,948 billion from KRW 6,103 billion in the third quarter of 2018 and decreased by 3% from KRW 7,126 billion in the fourth quarter of 2017. The 4Q revenue was attributed to increased shipments lead by the year-end seasonality, and the company’s focus on high-value-added products and by expanded shipments of new products in IT and small and medium-size panel segments, which have a higher average selling price per square meter.

Operating profit in the fourth quarter of 2018 recorded KRW 279 billion. This compares with the operating profit of KRW 140 billion in the third quarter of 2018 and the operating profit of KRW 45 billion in the fourth quarter of 2017.

Panels for TVs accounted for 36% of the revenue in the fourth quarter of 2018, mobile devices for 28%, tablets and notebook PCs for 22%, and desktop monitors for 14%.

LG Display also recorded KRW 24,337 billion in annual revenues and KRW 92.9 billion in annual operating profit in 2018.

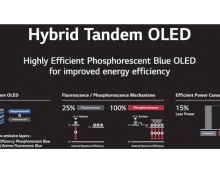

The company said it maintained its annual operating profit in 2018 thanks to expanding differentiated products such as OLED TV panels and high-end products including large-size and high-resolution panels, even though global competition is getting fiercer and panel prices have been showing decreasing trends.

It is notable that large-size OLED panels turned to profit in the latter half of 2018, five years after launching the products, driven by acquiring stable yield rates and productivity as well as expanding the customer base. Annual shipments of large-size OLED TV panels in 2018 increased to 2.9 million units, and the percentage of the annual revenues of large-size OLED TV panels increased to 20% of the total TV revenues.

“Panel area shipments in the first quarter of 2019 are expected to decrease by a high-single-digit percentage due to reduced panel demand stemming from low seasonality,” said Heeyeon Kim, Head of Investor Relations Division and Vice President of LG Display. “Average selling price per square meter in the first quarter is anticipated to decline by a mid- to high-single-digit percentage due to the downward trends in panel prices,” she added.

“We will speed up our shift to an OLED-focused business structure and will maximize efficiency in all business areas in order to solidify our financial strengths,” said Dong-hee Suh, the newly appointed CFO and Senior Vice President of LG Display. “We will complete our preemptive investment to prepare for the future within this year. By doing this, we are committed to leading the display market with OLED technology and generating stable profits,” he added.