Sales of Thin Hard Disk Drives Soar as PCs Slim Down

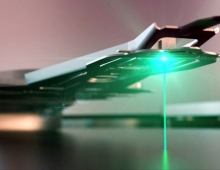

A new generation of thin hard disk drives (HDD) only 5.0 and 7.0 millimeters thick are expected to enjoy fast sales growth in coming years, as mobile computers including ultrathin PCs and PC tablets drive up demand by a factor of more than 25 from 2012 to 2017.

The combined shipments of 5.0- and 7.0-millimeter HDDs used in mobile PCs will reach 133 million units by 2017, up from just 5 million last year, according to information released by analytics provider IHS.

The 5.0- and 7.0-mm models will form a new class of ultraslim HDDs that are forecast to eventually displace the much thicker 9.5-mm drives that currently rule the industry. Shipments of the thicker 9.5-mm HDDs for mobile PCs will deteriorate to 79 million in 2017, down from 245 million units in 2012, IHS believes.

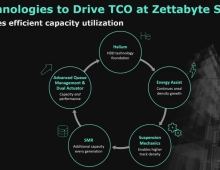

Both the 5.0- and 7.0-mm HDD products will see increasing adoption starting this year, along with another form of storage device known as the hybrid HDD, in which a NAND flash component or so-called cache solid-state drive (SSD) is joined with the hard drive within a single storage enclosure.

"Use of these new thin HDDs and hybrid HDDs will proliferate because these devices are smaller in size and have the capability to improve overall storage performance - important variables in an age that emphasizes smaller form factors as well as optimal speed at affordable prices," said Fang Zhang, storage systems analyst at IHS. "Both the thinner HDDs along with hybrid HDDs could even start finding acceptance in ultrathin PCs and tablet PCs - two products that now mostly use solid-state drives as their storage element. Hard disks have lost market share to SSDs, which offer better performance and can be more easily used to achieve a thinner and lighter form factor crucial to tablets and ultrathin PCs."

This year, for instance, the total SSD shipments will climb nearly 90 percent to 64.6 million units, while HDD shipments will decline 5 percent to 545.8 million units. However, the new and thinner HDDs eventually could stem losses of the hard disk space, especially if their costs can fall to 10-15 percent of a tablet or to 10-20 percent of an ultrathin PC, IHS believes.

These cost thresholds are important because they could be instrumental in persuading tablet and ultrathin PC brands to consider 5.0- and 7.0-mm. hard disks as possible alternatives to the SSDs now used as the predominant storage element. Solid-state drives are relatively expensive at present compared to other storage types and cut into the overall margins of computer and tablet makers, so the use of more economical storage alternatives that boost the bottom line of makers would make a persuasive argument to undertake a switch.

All three manufacturers of hard disk drives - Western Digital and Seagate Technology, as well as Toshiba - will have their own product offerings for the new and thinner HDDs.

Western Digital fired the opening salvo in April, announcing it had started shipping the 5.0-mm WD Blue ultraslim HDD and the Black SSHD - a solid-state hybrid drive with a hard drive component alongside the cache SSD - to select industry distributors as well as original equipment manufacturer customers.

Western Digital claims that the 500-gigabyte capacities of the two models will reduce weight by as much as 30 percent compared to a 9.5-mm HDD, with a circuit board utilizing cellphone miniaturization technology able to maximize the mechanical sway space in the hard drive to ensure shock resistance.

Western Digital then announced in June shipments of the world's currently thinnest 1-terabyte drive - the 7.0-mm. WD Blue - with both Acer and Asus likely to use the product in their upcoming ultrathin PCs.

For its part, Western Digital archrival Seagate announced also in June it had shipped 5.0-mm HDDs to Asus, Dell and Lenovo for their ultrathin PCs for the second half of 2013. Seagate says its 500-gigabyte hard drive occupies 25 percent less space than the company's 7.0-mm HDD.

Reacting to the developments from Western Digital and Seagate, Toshiba said it would ship a 7.0-mm solid-state hybrid drive (SSHD) in 320- and 500-gigabyte configurations, likewise by the end of June.

Previously, Toshiba only had a 9.5-mm SSHD of up to 750 gigabytes.

The 5.0- and 7.0-mm models will form a new class of ultraslim HDDs that are forecast to eventually displace the much thicker 9.5-mm drives that currently rule the industry. Shipments of the thicker 9.5-mm HDDs for mobile PCs will deteriorate to 79 million in 2017, down from 245 million units in 2012, IHS believes.

Both the 5.0- and 7.0-mm HDD products will see increasing adoption starting this year, along with another form of storage device known as the hybrid HDD, in which a NAND flash component or so-called cache solid-state drive (SSD) is joined with the hard drive within a single storage enclosure.

"Use of these new thin HDDs and hybrid HDDs will proliferate because these devices are smaller in size and have the capability to improve overall storage performance - important variables in an age that emphasizes smaller form factors as well as optimal speed at affordable prices," said Fang Zhang, storage systems analyst at IHS. "Both the thinner HDDs along with hybrid HDDs could even start finding acceptance in ultrathin PCs and tablet PCs - two products that now mostly use solid-state drives as their storage element. Hard disks have lost market share to SSDs, which offer better performance and can be more easily used to achieve a thinner and lighter form factor crucial to tablets and ultrathin PCs."

This year, for instance, the total SSD shipments will climb nearly 90 percent to 64.6 million units, while HDD shipments will decline 5 percent to 545.8 million units. However, the new and thinner HDDs eventually could stem losses of the hard disk space, especially if their costs can fall to 10-15 percent of a tablet or to 10-20 percent of an ultrathin PC, IHS believes.

These cost thresholds are important because they could be instrumental in persuading tablet and ultrathin PC brands to consider 5.0- and 7.0-mm. hard disks as possible alternatives to the SSDs now used as the predominant storage element. Solid-state drives are relatively expensive at present compared to other storage types and cut into the overall margins of computer and tablet makers, so the use of more economical storage alternatives that boost the bottom line of makers would make a persuasive argument to undertake a switch.

All three manufacturers of hard disk drives - Western Digital and Seagate Technology, as well as Toshiba - will have their own product offerings for the new and thinner HDDs.

Western Digital fired the opening salvo in April, announcing it had started shipping the 5.0-mm WD Blue ultraslim HDD and the Black SSHD - a solid-state hybrid drive with a hard drive component alongside the cache SSD - to select industry distributors as well as original equipment manufacturer customers.

Western Digital claims that the 500-gigabyte capacities of the two models will reduce weight by as much as 30 percent compared to a 9.5-mm HDD, with a circuit board utilizing cellphone miniaturization technology able to maximize the mechanical sway space in the hard drive to ensure shock resistance.

Western Digital then announced in June shipments of the world's currently thinnest 1-terabyte drive - the 7.0-mm. WD Blue - with both Acer and Asus likely to use the product in their upcoming ultrathin PCs.

For its part, Western Digital archrival Seagate announced also in June it had shipped 5.0-mm HDDs to Asus, Dell and Lenovo for their ultrathin PCs for the second half of 2013. Seagate says its 500-gigabyte hard drive occupies 25 percent less space than the company's 7.0-mm HDD.

Reacting to the developments from Western Digital and Seagate, Toshiba said it would ship a 7.0-mm solid-state hybrid drive (SSHD) in 320- and 500-gigabyte configurations, likewise by the end of June.

Previously, Toshiba only had a 9.5-mm SSHD of up to 750 gigabytes.