Samsung Q4 Net Falls, Forecasts Weaker 2019 Earnings on Slowing Memory Sales

Samsung Electronics Co. said Thursday its fourth-quarter net earnings declined 30.7 percent compared with a year ago due to weakening demand for its memory chips and smartphones.

The world's leading memory chip and smartphone manufacturer said its net earnings came in at 8.5 trillion won (US$7.6 billion) in the October-December period, compared with 12.2 trillion won a year earlier.

Its operating profit slid 28.7 percent on-year to 10.8 trillion won, and sales fell 10.2 percent to 59.2 trillion won in the last three months of 2018.

Fourth quarter earnings were affected by a drop in demand for memory chips used in data centers and smartphones. The System LSI and Foundry businesses also saw profits decline due to weak seasonality.

Overall earnings at the Display Panel Business decreased slightly due to growing competition between mobile display makers.

In the IT & Mobile Communications (IM) Division, smartphone shipments and prices fell in the fourth quarter in a stagnant but highly competitive market, despite strong seasonal demand. However, the Networks Business reported gains on the back of 5G equipment installations and expansion of LTE networks.

Quarterly earnings increased in the Consumer Electronics (CE) Division, led by strong sales of premium TVs, such as QLED TVs.

For the Foundry Business, earnings fell in the fourth quarter on weak seasonality and as the struggling crypto currency market put in less orders for mining chips. Samsung expects foundry demand in the first quarter to remain stagnant due to the slow demand for mobile components and crypto currency mining chips. The company, while concentrating preparations for a full-scale production of the 7-nano EUV process in the second half, will complete the development of the 5-nano EUV process. Additionally, the foundry Business will increase its customer base by over 40 percent from the previous year, as part of efforts to further stabilize the business structure.

For 2018, Samsung posted a record high of 58.9 trillion won in operating profit as a super cycle in memory chips boosted its overall profitability.

Its annual sales and net profit stood at 243.8 trillion won and 44.3 trillion won, respectively. This marked a second straight year of setting record financial results, even as unfavorable business and macroeconomic factors led to slower performance in the final quarter.

Looking ahead, Samsung expects demand in the Memory Business to remain weak in the first quarter due to seasonality and macroeconomic uncertainties as well as inventory adjustments by major customers. For OLED, profitability is likely to decline, weighed on by slow sales of premium smartphones and rising competition with LTPS LCD products. As for LCD, earnings are expected to decline as a result of large-scale capacity expansions in the industry.

Earnings in the IM Division are likely to improve in the first quarter, helped by the planned launch of the new flagship Galaxy smartphone and the introduction of commercial 5G telecom services in Korea. The CE Division will unveil new TV models and focus on premium home appliances, in order to prioritize profitability in a slower season.

However, overall smartphone shipments are likely to remain at a similar level QoQ as shipments of the company’s mass-market models have temporarily declined due to a lineup reorganization.

For the whole of 2019, demand for smartphones is expected to maintain the same level seen in 2018 while market ASP is projected to rise due to a trend toward adopting high-end features such as large screens, higher memory capacity, and multi-cameras.

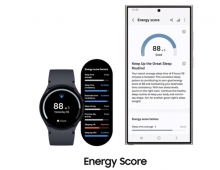

This year, Samsung aims to lead trends in the market by launching foldable and 5G devices in efforts to ensure sustainable growth. By cooperating with business partners, Samsung will secure optimized content and expand into new markets. User retention will be increased by strengthening connectivity between devices. As part of this plan, Samsung will expand Bixby to various devices and connected services while improving its AI capabilities.