Smartphone Market Returned to Growth After Two years

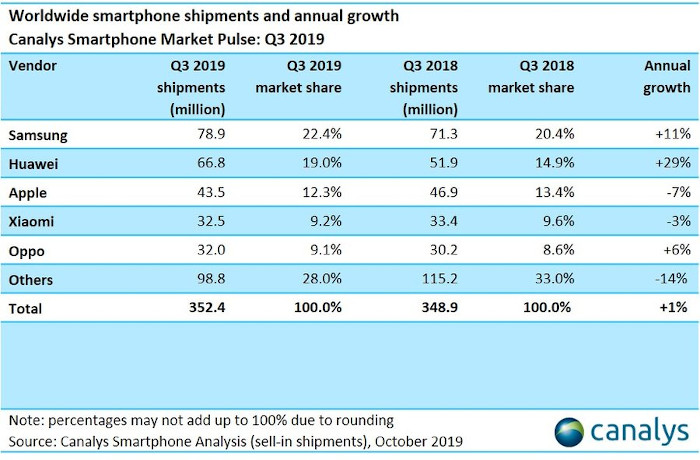

Global smartphone shipments grew 1% in Q3 2019, bucking two years of declines, as a range of market stimuli aligned to drive demand.

According to Canalys, Samsung topped the rankings and shipped 78.9 million devices, up 11%, as its strategy to sacrifice operating profit in pursuit of market share gained traction. Huawei bounced back from a weak Q2 and was second with 66.8 million units, up 29%, as pent-up channel demand caused a surge in volume of shipments. Apple, in third place, shipped 43.5 million units, a decline of 7%, caused mainly by weak performance of iPhone XR, XS and XS Max in the lead up to its September launch event. However, this number was higher than it could have been, as Apple launched three iPhones in September for the first time ever. Xiaomi and Oppo completed the top five vendors, shipping 32.5 million and 32.0 million units respectively.

Samsung shipped 78.9 million units in Q3 2019, up 11% from Q3 2018. It has implemented an aggressive new product strategy to regain lost market share. Its Galaxy A series has now displaced the old Galaxy J family, and each product now packs much better price-to-spec. And at the high-end, it increased the number of models, a trend which started with Galaxy S10 in February, and continues with the new Galaxy Note10. The Note10 boasts two screen sizes for the first time, as well as separate 5G variants, which adds cost and complexity to Samsung, and has impacted profitability at the high-end. However, it has culminated in greater volume, with the Galaxy Note10 family out-shipping last year’s Note9 by more than 5%.

Huawei boosted its shipments to 66.8 million, up 29%, a stunning uplift after the damage caused by the US Entity List ruling in Q2. Its strength was underpinned by rampant performance in China, but it also improved its fortunes in many overseas markets where volume increased sequentially from 21.5 million in Q2 to 25.3 million in Q3, as many distributors and operators resumed procurement for Huawei smartphones which had been paused in Q2. This pent-up demand for Huawei devices caused a surge in orders.

“Huawei is not out of the woods yet,” said Canalys Senior Analyst, Ben Stanton. “Its shipments overseas in Q3 were focused on pre-Entity List models, with P30 Lite its best shipper, at close to three million units. But its post-Entity List models, like Mate 30, bring uncertainty because there is resistance from channels in critical overseas markets, like Europe, to support Huawei devices without Google Mobile Services. Huawei does have the potential to rapidly bring GMS to its devices if the political situation changes, but time is not on its side. It is nearing the launch timeframe for new Y-series and P-series devices in early 2020. These families are major volume drivers for Huawei, and accounted for 64% of its volume in the first half of this year. It will be a major challenge to retain its overseas volume if the Entity List saga is not resolved in the coming months.”

Apple’s shipments fell 7% to 43.5 million units in Q3, an improvement on the double-digit declines in Q1 and Q2 2019.

“iPhone 11 has launched to strong reviews,” said Canalys research analyst Vincent Thielke. “It has tangible improvements in camera and battery life, and its discount versus the iPhone XR was a welcome surprise to consumers. However, Apple devices do not have 5G and it will have to contend with that in early 2020. It will miss out on heavy operator investment in 5G marketing and promotions, and the wide expectation for Apple to launch a 5G iPhone in September 2020 may convince some customers to delay purchasing, to ensure their device is future-proof. Apple will need an unconventional strategy to keep its volume high in the early stages of next year, which makes rumors of an upcoming entry-level iPhone launch in H1 2020 unsurprising.”